Cognex (NASDAQ:CGNX), a leading provider of vision systems, sensors, and software used in manufacturing automation, raised its third-quarter revenue outlook ahead of the company’s Analyst Day event scheduled for September 20. The company now expects Q3 revenue in the range of $195 million to $205 million. Last month, Cognex issued disappointing Q3 revenue guidance of $160 million to $180 million.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Cognex shares spiked 5.7% in Monday’s extended trading session in reaction to the upbeat guidance. However, shares are down nearly 46% year-to-date.

What Drove Cognex’s Improved Q3 Revenue Outlook?

Cognex attributed its Q3 revenue guidance upgrade to its “ability to fulfill customer demand sooner than anticipated due to strong progress in replenishing component inventory destroyed in the previously disclosed fire at the company’s primary contract manufacturer.”

Cognex also stated that at the Analyst Day it would discuss the updated view of its estimated served market, which is now worth $6.5 billion compared to an estimation of $4.2 billion in 2019. Furthermore, the company now expects a long-term compound annual revenue growth target of 15% “over the medium-to-long term.”

Last month, Cognex shares tanked after the company missed analysts’ Q2 revenue and earnings expectations and issued a dismal Q3 outlook.

Is Cognex a Buy?

In August, J.P. Morgan analyst Paul J. Chung downgraded his rating for Cognex stock to a Sell from Hold but maintained his price target at $40.

Chung explained, “Customer concentration risk remains elevated at Amazon and Apple, and given pause in logistics spending at Amazon which drove $300mm in revenues [fiscal 2021] ~up 65% [year-over-year], we sense we may see multiple years of digestion.”

Chung also noted that the Street’s Q4 estimates might be “a bit high” and do not take into account several factors, including currency headwinds, higher costs, and inventory destruction at the company’s key manufacturing partner.

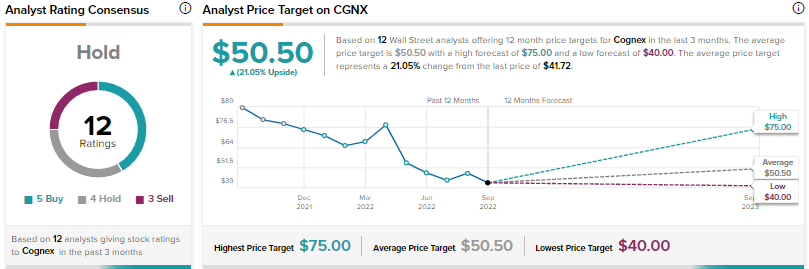

Overall, the Street has a Hold consensus rating on Cognex based on five Buys, four Holds, and three Sells. The average CGNX price target of $50.50 implies 21.1% upside potential.

Conclusion

Cognex’s upgraded Q3 revenue guidance might help its shares recover to some extent, though investors will continue to look for more clues on the company’s ability to deliver improved results in the upcoming quarters despite macro challenges.