After market close today, Cogeco Communications (TSE:CCA), a communications company that provides Internet, video, and telephony services, reported its Fiscal Q1-2023 earnings. Its earnings per share came in at C$2.44, beating analysts’ consensus estimate of C$2.30 and registering 7.5% growth. In the past nine quarters, the company has beaten estimates six times. In addition, sales increased 6.1% year-over-year (2.3% on a constant-currency basis), with revenue hitting C$762.3 million compared to C$718.5 million. This was ahead of estimates calling for C$746.9 million in revenue.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Additionally, adjusted EBITDA increased by 5.1% — 1.8% on a constant-currency basis, and net profit increased by 3.2%. Since profits couldn’t keep up with revenue growth, it implies that CCA’s profit margin fell.

Also, the company’s free cash flow fell by 20.4% year-over-year to C$105.1 million due to increased capital expenditures related to network expansion projects. When adjusting for these projects, free cash flow increased by 12.4%, reaching C$171 million, according to the company.

Cogeco also revised its Fiscal 2023 guidance lower compared to its estimates from six months ago. CCA expects revenue growth of 0.5%-2.0% compared to 2%-4%, and adjusted EBITDA growth is expected to come in at 0.5%-2.0% compared to previous estimates of 1.5%-3.5%. Free cash flow estimates remained the same, and the figure is forecast to decline by 2%-12% due to increased investments in growth.

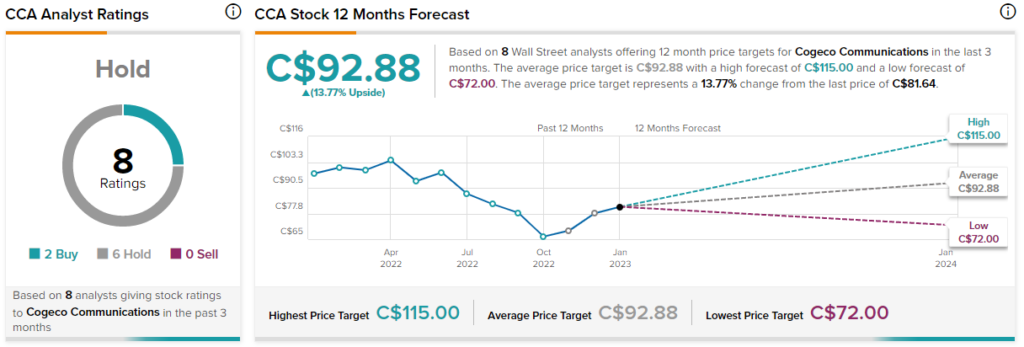

Is Cogeco Stock a Buy, According to Analysts?

Cogeco has a Hold consensus rating based on two Buys and six Holds assigned in the past three months. The average CCA price target of C$92.88 implies 13.8% upside potential.