The American multinational beverage corporation Coca-Cola (KO) has announced that it will double its spending with minority-owned media firms by 2024. The company said media companies owned by Black, Hispanic, Asian-American and Pacific Islander (AAPI), and other partners will account for 8% of the company’s total annual media budget in North America by 2024.

The company has increased its spending with minority-owned media firms by five times in 2021 compared with 2020. (See Coca-Cola stock charts on TipRanks)

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Chief marketing officer of the North America operating unit at Coca-Cola, Melanie Boulden, said, “We must take a leadership role, and that is why we are not only committing to increase our investment with minority-owned media companies but also focused on non-media partnerships and empowerment initiatives designed to foster growth and increase the competitive advantage of minority businesses and communities.”

Argus Research analyst Chris Graja recently maintained a Buy rating on the stock and increased the price target from $60 to $63 (15.9% upside potential).

Graja also raised his earnings per share (EPS) guidance on Coca-Cola to $2.40 from $2.35 for fiscal 2022 on the back of higher sales and transformational efficiencies.

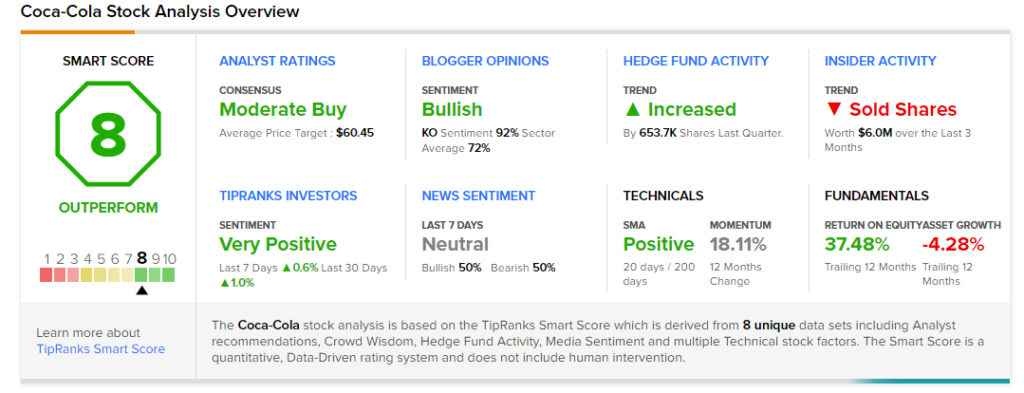

Overall, the stock has a Moderate Buy consensus rating based on 8 Buys and 4 Holds. The average Coca-Cola analyst price target of $60.45 implies 11.2% upside potential from current levels. The company’s shares have gained around 19% over the past year.

According to TipRanks’ Smart Score rating system, KO scores an 8 out of 10, implying that the stock is likely to outperform market averages.

Related News:

Northern Trust to Provide Asset Servicing Solutions to Fundsmith

Fiserv Announces JV with Deutsche Bank

Core One Labs Begins To Develop a New Psychedelic Drug, Files Provisional Patent Application