Coca-Cola (KO) and PepsiCo (PEP) are two of the world’s biggest beverage companies and long-time favorites of dividend investors. Both offer steady cash flows and a history of rewarding shareholders, but their stocks have performed very differently this year. PepsiCo’s stock is down about 7% year-to-date, while rival Coca-Cola has gained roughly 7%. Let’s compare their dividends, growth prospects, and recent results to see which one looks like the smarter pick for income-focused investors today.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Is PepsiCo a Good Dividend Stock?

PEP stock’s decline mainly comes from PepsiCo’s sluggish North American performance. In Q2 2025, PepsiCo’s global food sales fell 1.5%, while drinks stayed flat. In North America, food volume dropped 1%, and U.S. drink sales fell 2%. Looking ahead, the company expects flat core earnings and only low single-digit revenue growth, which has also weighed on investor confidence.

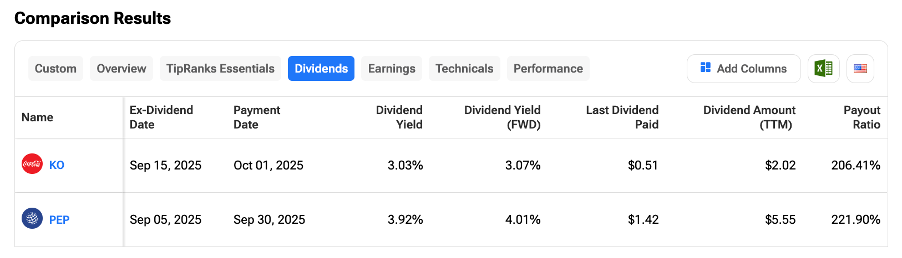

Amid these challenges, PepsiCo stands out for income-focused investors with its reliable payouts. The company has increased its dividend for 53 straight years and currently pays $1.4225 per share each quarter, giving a 4% yield, well above the sector average of about 2.5%.

Earlier this month, activist investor Elliott Investment Management revealed a $4 billion stake in PepsiCo, prompting the company to consider refranchising its bottling business and other moves to lift its declining share price. Elliott’s plan includes reviewing PepsiCo Beverages North America’s structure, reshaping PepsiCo Foods North America’s assets, driving profitable growth, setting clear targets, and strengthening accountability, seeing potential for the stock to gain over 50%.

Is Coca-Cola a Dividend King?

In terms of financials, Coca-Cola reported adjusted EPS of $0.87, topping estimates of $0.83 and rising 4% from Q2 FY24. At the same time, revenue grew 2.5% to $12.62 billion, beating the $12.54 billion forecast, driven by strong soda demand in Europe. However, global unit case volume slipped 1%, with only Europe, the Middle East & Africa posting a 3% gain.

Speaking of dividends, Coca-Cola’s record is hard to beat. The company has paid shareholders for 103 years and has raised its dividend for 63 straight years, marking one of the longest streaks in the market. That run began in 1962 and has continued through recessions, market crashes, pandemics, and even periods of high inflation. The company currently has a dividend yield of 3.03%.

Additionally, Warren Buffett has owned Coca-Cola since 1988, making it Berkshire Hathaway’s ($BRK.A) longest-held stock. Buffett often praises Coca-Cola as a global brand and a top dividend payer.

KO or PEP: Which Stock Offers Higher Upside, According to Analysts?

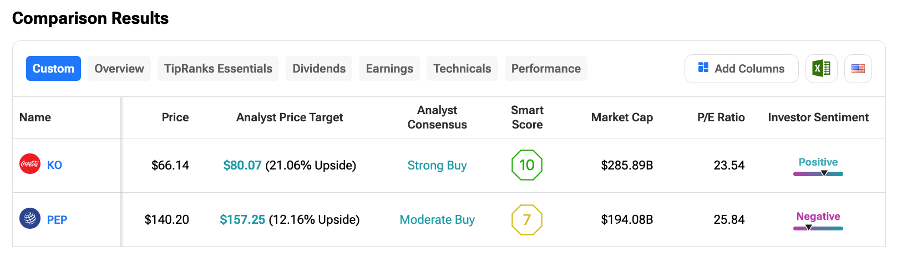

Using TipRanks’ Stock Comparison Tool, we have compared KO and PEP to see which stock offers higher upside to investors. KO stock currently holds a Strong Buy rating, with an average price target of $79.88, implying a 20% upside from current levels.

On the other hand, PEP stock carries a Moderate Buy consensus among 13 analysts. PepsiCo’s average stock price target of $157.25 suggests an upside of 12%.

Conclusion

Both Coca-Cola and PepsiCo have strong dividend records and powerful global brands, making them solid picks for income investors. Coca-Cola shines with its unmatched 63-year streak of dividend increases, while PepsiCo offers steady dividend growth and a more diverse mix of drinks and snacks. Investors wanting a higher yield and a classic dividend king may prefer Coca-Cola.