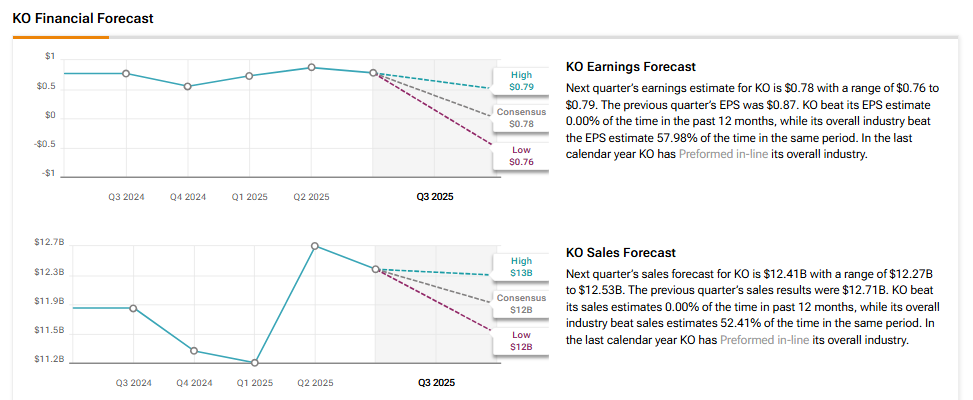

Beverage giant Coca-Cola (KO) is scheduled to report its third-quarter earnings on Tuesday, October 21. KO stock has risen 12% year-to-date, as investors believe in its resilience, solid brand name, pricing power, and ability to navigate ongoing macro and tariff challenges. Wall Street expects Coca-Cola to report Q3 earnings per share (EPS) of $0.78, reflecting a 1.3% year-over-year decline.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, the company is expected to report revenue of $12.41 billion, indicating a 4% growth over the prior-year quarter.

Analysts’ Views Ahead of Coca-Cola’s Q3 Earnings

Heading into the Q3 results, Piper Sandler analyst Mike Lavery kept an Overweight rating on Coca-Cola with a price target of $80, pointing to new retail moves and product launches as key growth drivers.

Lavery said Coca-Cola is working more closely with convenience stores to increase sales. The company is rolling out mini cans that will now be sold as single-serve drinks for the first time. This gives shoppers more options, especially those who want smaller portions or cheaper buys. The cans fit easily into coolers without replacing other products, and early tests have already boosted sales.

He also noted that Coca-Cola is pushing new products and strong marketing, including upcoming launches like Coca-Cola Cherry Float, the return of Sprite + Tea, and Powerade Power Water. A major global ad campaign tied to next year’s World Cup is also expected to lift demand and support further growth.

Here’s What Options Traders Anticipate Ahead of KO’s Q3 Earnings

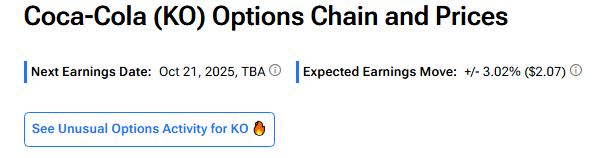

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting about a 3.02% move in either direction in Coca-Cola stock in reaction to Q3 results.

Is KO a Good Stock to Buy?

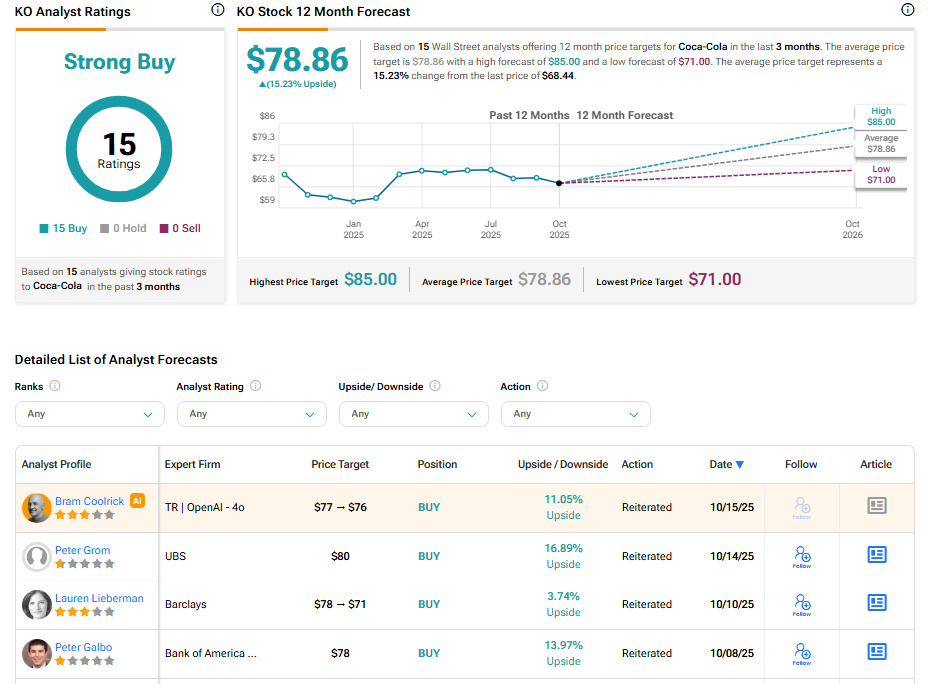

Currently, Wall Street has a Strong Buy consensus rating on Coca-Cola stock based on 15 unanimous Buy recommendations. The average KO stock price target of $78.86 indicates 15.23% upside potential from current levels.