Coca-Cola (KO) is updating its Wakefield, West Yorkshire bottling factory to be more environmentally sustainable. That includes adding nitrogen production equipment to the facility, allowing the soda company to handle adding nitrogen to its drinks without the need for delivery of the chemical from third parties.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

According to Coca-Cola, this cuts down on carbon emissions as it won’t need fuel spent on nitrogen deliveries. The company also notes that this change will cut down on costs. This is huge, as the Wakefield plant produces one-third of the soft drinks that Coca-Cola sells in the UK.

Coca-Cola did face some pushback from locals over the addition of a nitrogen production facility. However, the additional equipment will be located on its plant, and the company is following all regulatory and safety measures for creating the chemical. This clears the way for it to bring nitrogen production in-house.

KO Stock Performance

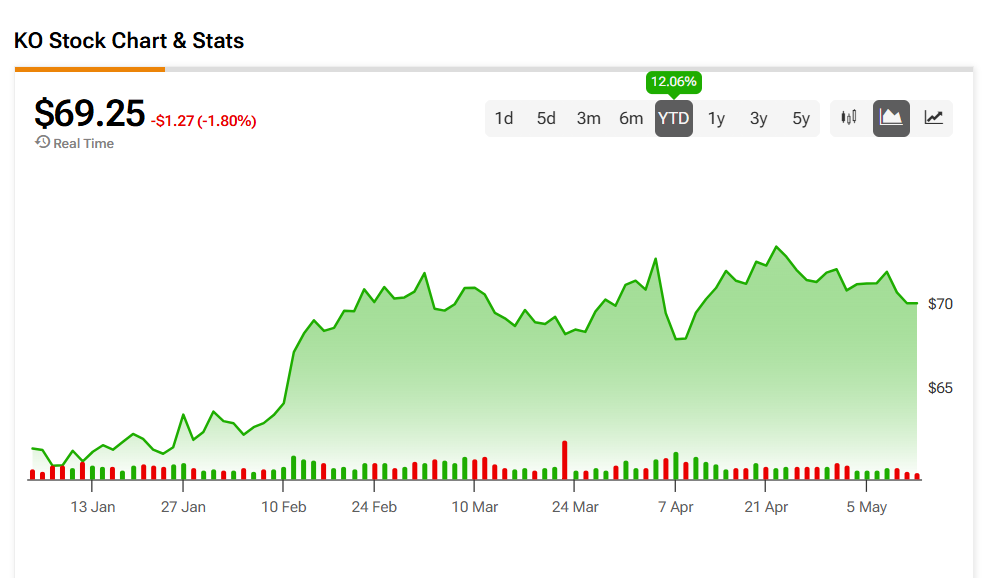

KO stock has been one of the winners of 2025 so far with the shares up 12.06% year-to-date. That’s seen it outperform the Dow Jones (DJIA) and other major stock indices. Its designation as a consumer defensive stock has helped it grow despite economic uncertainty and a trade war.

However, KO stock was down 1.8% as of Monday afternoon. This could be due to a deal between the U.S. and China that put tariffs on hold for 90 days. That could have investors considering stakes in other companies as stocks rally today.

Is KO Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Coca-Cola is Strong Buy, based on 16 Buy and one Hold ratings over the last three months. With that comes an average KO stock price target of $79.33, representing a potential 14.47% upside for the shares.