In this piece, I evaluated a pair of fast-food/casual stocks, Chipotle Mexican Grill (NYSE:CMG) and McDonald’s (NYSE:MCD), using TipRanks’ comparison tool to see which stock is a better buy. A closer look suggests a neutral view for both, although a clear winner does emerge.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Chipotle Mexican Grill is a fast-casual dining chain that serves fresh Mexican food, mostly in the U.S., while McDonald’s is a leading fast-food chain with over 30,000 restaurants owned and franchised in over 100 countries.

Shares of Chipotle Mexican Grill are up 9% year-to-date, bringing their one-year gain to 52%. On the other hand, McDonald’s stock is down 3% year-to-date, although it’s up 12% over the last year.

To gauge their valuations against each other and that of their industry, we’ll compare Chipotle’s and McDonald’s price-to-earnings ratios. For comparison, the U.S. restaurant industry is trading at a P/E of 49.1 versus its three-year average of 91.

Chipotle Mexican Grill (NYSE:CMG)

At a P/E of 60, Chipotle Mexican Grill is trading at a premium to its industry, although it typically does, as evidenced by its one-year mean P/E of 51.9 and its three-year mean P/E of 67.7. However, following Wednesday’s post-earnings rally, a neutral view seems appropriate — pending a more attractive entry point.

There’s no denying that Chipotle Mexican Grill put up some excellent numbers for the fourth quarter. The dining chain reported adjusted earnings of $10.36 per share on $2.52 billion in revenue versus the consensus estimates of $9.70 per share and $2.49 billion in sales.

Same-store sales rose 8.4%, easily beating the StreetAccount estimate of 7.1%, while foot traffic increased by 7.4%, putting Chipotle in a league of its own, given the industry-wide trend of falling traffic during the fourth quarter.

After Wednesday’s rally, the stock appears to be in overbought territory with a Relative Strength Index of 76.9. An RSI over 70 suggests a stock could be overbought. To put Chipotle’s price into context, its stock was trading a little below $2,500 a share on Tuesday before the earnings release, and it soared to a new record high of over $2,700 on Wednesday, although it did fall slightly since then.

At this point, it seems prudent to wait for a pullback in Chipotle shares before buying. The stock has certainly had its ups and downs over the years, so it seems like just a matter of time before a more attractive entry price will temporarily present itself.

Notably, Chipotle shares are up 312% over the last five years, so this stock would be worth buying and holding for the long term after a position is established, preferably at a lower price.

What Is the Price Target for CMG Stock?

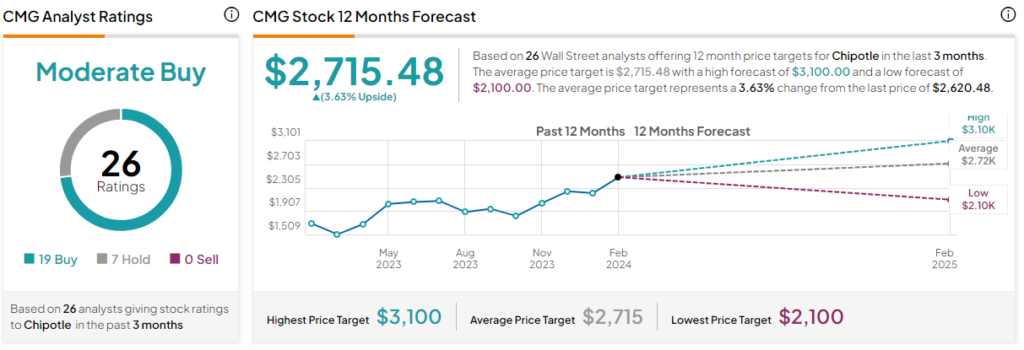

Chipotle Mexican Grill has a Moderate Buy consensus rating based on 19 Buys, seven Holds, and zero Sell ratings assigned over the last three months. At $2,715.48, the average Chipotle Mexican Grill stock price target implies upside potential of 3.6%.

McDonald’s (NYSE:MCD)

At a P/E of 24.9, McDonald’s is trading at a discount to its industry and Chipotle, although it typically does. More importantly, McDonald’s is trading at a meaningful discount to its one-year mean P/E of 28.6 and its three-year mean P/E of 29.3. However, a neutral view seems appropriate alongside a wait-and-see approach due to the company’s sales trends.

For the fourth quarter, McDonald’s reported adjusted earnings of $2.95 per share on $6.41 billion in revenue versus the consensus estimates of $2.83 per share in earnings on $6.45 billion in sales. Unfortunately, global same-store sales rose just 3.4%, coming up far short of the expected 4.7% growth.

Management cited the turmoil in the Middle East as the primary reason for the weaker-than-expected same-store sales. McDonald’s said boycotts dented its sales in the Middle East after its licensee in Israel offered discounts to soldiers. The company also had to temporarily close some locations to protect employees from protests.

As a result, the fast-food chain’s International Developmental Licensed Markets segment, which includes the Middle East locations, recorded a same-store sales increase of only 0.7%. Notably, the International Licensed segment was McDonald’s best-performing segment a year ago, surpassing 16% sales growth.

Meanwhile, domestic same-store sales increased 4.3% in the fourth quarter, roughly in line with expectations. However, during the third quarter, McDonald’s said its domestic traffic took a hit due to low-income customers cutting back on spending.

As a result, if this trend continues, and especially if the company continues to see problems with international sales, it could enter a rough patch. Thus, a wait-and-see approach seems prudent at this time. McDonald’s certainly isn’t going anywhere and will likely become a great buy-and-hold position at some point, but that time probably isn’t now.

What Is the Price Target for MCD Stock?

McDonald’s has a Moderate Buy consensus rating based on 21 Buys, nine Holds, and zero Sell ratings assigned over the last three months. At $323.57, the average McDonald’s stock price target implies upside potential of 10.8%.

Conclusion: Neutral on CMG and MCD

Although both dining chains receive a neutral rating, Chipotle Mexican Grill is the clear winner because the problem isn’t with the company or even its market. The issue is purely its valuation, as it looks like euphoria took hold after the fourth-quarter report. Additionally, the constant ups and downs in Chipotle’s share price suggest there will likely be a better entry price at some point.

On the other hand, McDonald’s missed sales estimates in its latest earnings report, and the possibility of a slowing economy doesn’t bode well for it either. We already saw in the third quarter how the company’s domestic sales took a hit from low-income customers cutting back on spending.

Thus, a wait-and-see approach may be best for McDonald’s. Meanwhile, Chipotle is worth constant monitoring for a significant share-price drop, as history has demonstrated that those price drops end up being only temporary.