The CME Group (NASDAQ:CME), which recently introduced event contracts on Bitcoin (BTC-USD) futures, plans to further expand its suite of cryptocurrency options. Starting May 22, the leading derivatives marketplace is introducing standard- and micro-sized Bitcoin and Ethereum (ETH-USD) contracts with daily business-week expiries.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The launch of Bitcoin futures and the introduction of contracts with daily expiries by a fully regulated platform like CME is a positive development for these digital currencies.

CME’s global head of cryptocurrency products, Giovanni Vicioso, said that customers are looking to regulated and reliable avenues like CME Group for cryptocurrency risk management products amid heightened volatility in the digital asset sector.

The move comes after CME’s Bitcoin and Ether futures and options complex achieved daily average volume in the first quarter of 2023. CME announced that the Bitcoin and Ether futures and options complex recorded a daily average notional of more than $3 billion, reflecting higher client demand for liquid hedging tools.

With heightened volatility in digital assets due to macro uncertainty, the demand for CME’s cryptocurrency risk management products will likely remain high. Meanwhile, the prices of Bitcoin and Ethereum, the two major digital currencies, marked a swift recovery in 2023, increasing by 78% and 74%, respectively.

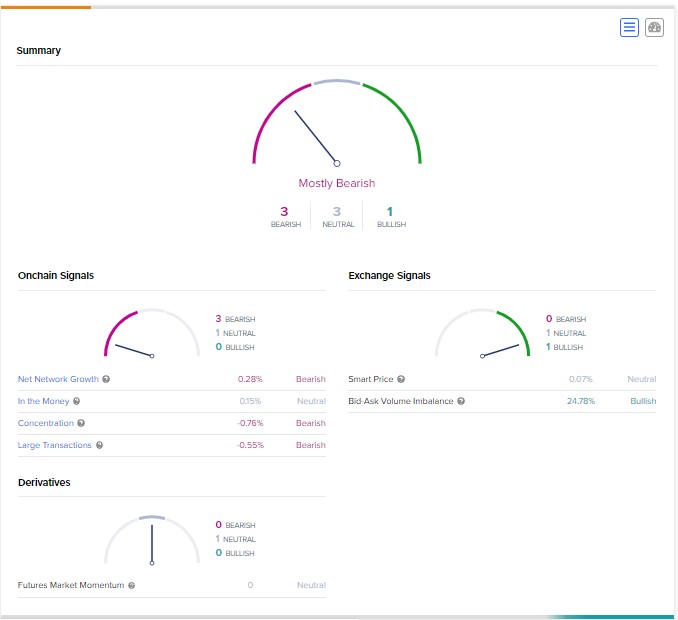

While Bitcoin has gained quite a lot, TipRanks’ BTC-USD analysis tool provides a bearish signal.