Shares of internet solutions and cloud-based cybersecurity service provider Cloudflare (NYSE:NET) jumped nearly 24% higher in Thursday’s after-hours of trade. This spike in NET stock came after the company reported stellar Q4 earnings, which more than doubled and exceeded the Street’s forecast.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What stood out is that the company added 198 new large customers who pay more than $100,000 annually. Overall, it had 2,756 large customers at the end of the quarter, up 35% year-over-year.

During the quarter, the company secured its largest contract to date, with a value exceeding $30 million. Furthermore, the annual contract value (ACV) of newly acquired contracts increased by nearly 40% year-over-year.

Cloudflare: A Brief Look at its Q4 Financials

Cloudflare delivered total revenue of $362.5 million in Q4, up 32% year-over-year. Its top line exceeded analysts’ expectations of $353.1 million. The solid year-over-year growth reflects strength across all its major geographic regions, with the U.S. recording an increase of 30%. Cloudflare had 189,791 paying customers at the end of Q4, up 17% year-over-year. Further, the company’s large customers represented 64% of its total revenue.

Thanks to the stellar top-line growth, Cloudflare delivered adjusted earnings of $0.15 per share, up 150% year-over-year. Further, it surpassed analysts’ average estimate of $0.12.

Q1 and 2024 Guidance

Looking ahead, Cloudflare expects Q1 revenue to be in the range of $372.5 million to $373.5 million. Analysts expect the company to post revenues of $372 million. Moreover, Cloudflare expects adjusted earnings to be $0.13 per share, which is better than analysts’ estimate of 12 cents.

As for 2024, Cloudflare projects its total revenue to be between $1.648 billion and $1.652 billion. Meanwhile, its bottom line is forecasted to be in the range of $0.58 to $0.59 per share. Analysts expect Cloudflare to post earnings of $0.54 per share on revenue of $1.65 billion.

Is Cloudflare a Buy or Sell?

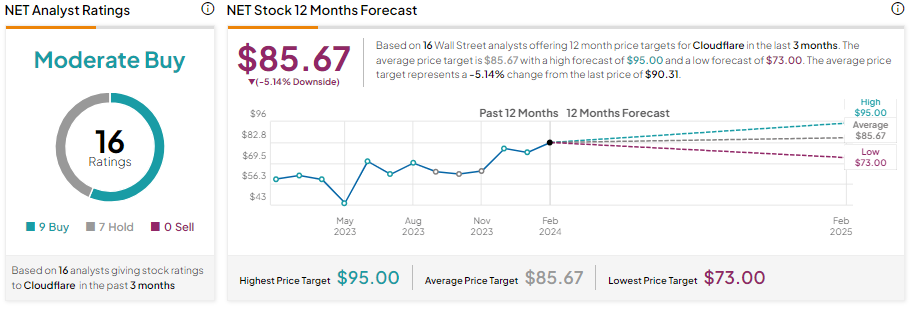

Cloudflare stock has appreciated by over 55% in one year. Given the significant increase in its share price, analysts’ average price target of $85.67 implies 5.14% downside potential from current levels.

It’s worth noting that most of the price targets on NET stock were set before the Q4 earnings report. This raises the possibility that Cloudflare stock might witness upward adjustments in price targets from analysts.

Wall Street analysts are cautiously optimistic about NET stock. It has nine Buy and seven Hold recommendations for a Moderate Buy consensus rating.