It’s an exciting day for Cloudflare (NYSE:NET) as it blasts up over 6% in Wednesday afternoon’s trading. The reason behind the jump? Cloudflare has been busily building partnerships with a wide array of businesses, which in turn means new products, new markets, and new profits.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The new string of partnerships starts simply with Meta Platforms (NASDAQ:META), where it has a hand in bringing out the Llama 2 open-source large language model for use in AI development. This includes development for Workers, which is Cloudflare’s own developer platform. Workers will also open up several other options; Llama 2 is not the only model that developers can put to work. There are models for automatic speech recognition, sentiment analysis, and much more. Cloudflare also has deals in the works with Nvidia (NASDAQ:NVDA) and Hugging Face, among others.

This may sound like a lot of deals all at once, but Cloudflare is up to the job. Recently, it was revealed that Cloudflare handles roughly 20% of all web traffic. It recently brought out its new Traffic Manager tool, which uses machine learning to help provide all those vital connections between data centers, cloud-based systems, and enterprises all at once. With that kind of horsepower, it’s little surprise that Cloudflare is seen as connected to some of the biggest names in web development, among others.

Is Cloudflare a Buy, Sell, or Hold?

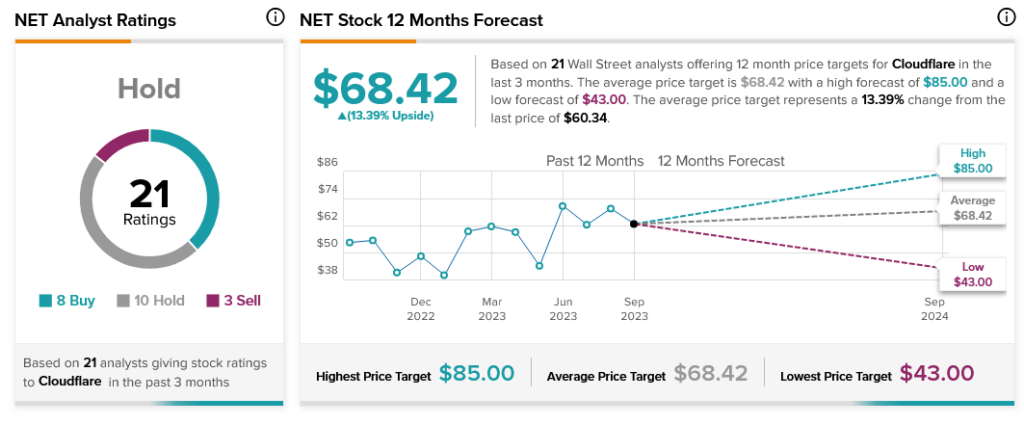

Despite this incredible array of connections, analysts are still proving cautious. Currently, Cloudflare stock is considered a Hold, supported by eight Buy ratings, 10 Holds, and three Sells. Nonetheless, Cloudflare stock offers investors 13.39% upside potential thanks to its average price target of $68.42.