Tech giant Amazon (NASDAQ:AMZN) announced market-beating results for the first quarter. Nonetheless, shares declined 2% after rallying initially in Thursday’s extended trading session as the company cautioned about further deceleration in its Amazon Web Services (AWS) cloud business.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Continued Slowdown in AWS Growth

Amazon’s Q1 2023 revenue grew over 9% to $127.4 billion, with AWS revenue rising about 16% to $21.4 billion. While AWS segment’s revenue growth was better than the growth in the company’s e-commerce revenue, investors are concerned about the persistent slowdown in the segment’s business. AWS segment’s revenue grew 20% and 28% in Q4 and Q3 2022, respectively.

Given that the AWS cloud business is considered to be a key growth driver, the company’s commentary on further slowdown added to investors’ woes. Moreover, investors are worried about AWS losing market share to rival Microsoft’s (NASDAQ:MSFT) Azure.

During the Q1 earnings call, Amazon’s CFO Brian Olsavsky said, “As expected, customers continue to evaluate ways to optimize their cloud spending in response to these tough economic conditions in the first quarter.”

The CFO further added that customers continued to optimize their spending in the second quarter, with April AWS revenue growth down about 500 basis points compared to the movement seen in the first quarter. Olsavsky said that the AWS sales and support teams are working with the customers amid the ongoing macro challenges and emphasized the focus on the long-term growth of the business.

Meanwhile, Amazon is improving its profitability by lowering its costs through various initiatives, including 27,000 job cuts announced over recent months. On the positive side, the growth potential of the company’s advertising business seems attractive. In Q1 2023, advertising revenue grew 21% to $9.51 billion. The company attributed this growth to its vast e-commerce customer base and huge investments in machine learning.

Is Amazon a Buy, Hold, or Sell?

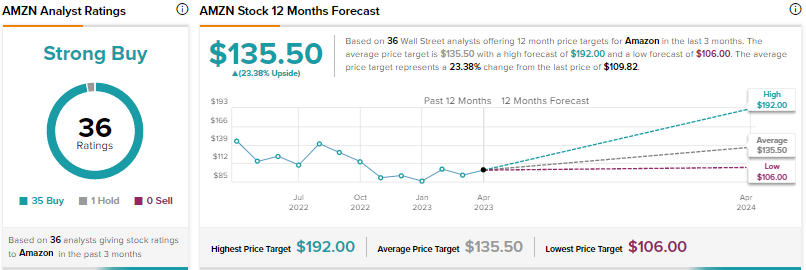

Wall Street’s Strong Buy consensus rating for Amazon stock is based on 35 Buys and one Hold. The average price target of $135.50 suggests 23.4% upside. Shares have risen 31% year-to-date.