Shares of Cleveland-Cliffs (NYSE: CLF) gained in after-hours trading after the company reported earnings for its second quarter of Fiscal Year 2023. Earnings per share came in at $0.67, which missed analysts’ consensus estimate of $0.69 per share. Sales decreased by 5.7% year-over-year, with revenue hitting $5.98 billion. However, this beat analysts’ expectations by $190 million. The revenue breakdown for the steelmaking sector, totaling $5.8 billion, is as follows:

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Direct automotive market sales – $2 billion

- Infrastructure and manufacturing – $1.6 billion

- Distributors and converters – $1.4 billion

- Sales to steel producers – $796 million

Looking forward, management expects to reduce its steel costs by $40 per net ton from the second quarter to the third quarter, followed by another $10 per ton reduction from the third to the fourth quarter.

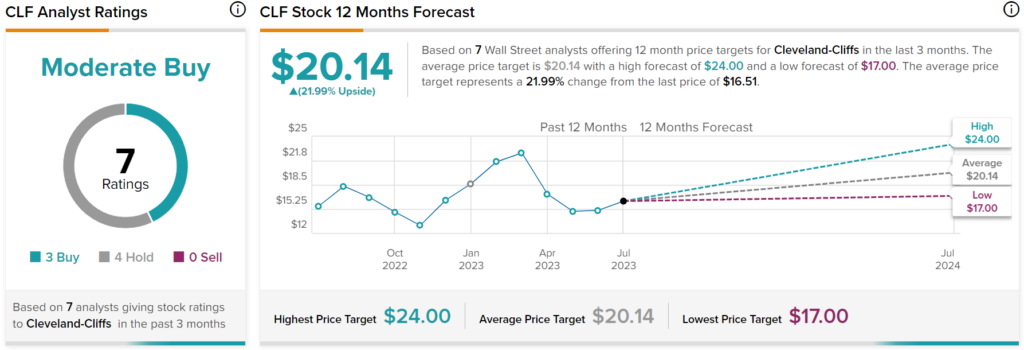

Overall, Wall Street has a consensus price target of $20.14 on CLF stock, implying 22% upside potential, as indicated by the graphic above.