A class action suit was initiated against Xponential Fitness, Inc. (NYSE:XPOF) on February 9, 2024. The plaintiffs in the federal securities class action allege that they acquired the stock at artificially inflated prices between July 26, 2021 and December 7, 2023. Investors who bought XPOF stock during that period can learn about joining the lawsuit here: https://zlk.com/pslra-1/xponential-fitness-lawsuit-submission-form?wire=16.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Xponential, a franchisor of ten boutique fitness brands, is accused of deceiving investors by lying and withholding key information about the company’s business practices and prospects. The plaintiffs maintain that the company and two of its senior officers omitted information about the company’s franchisees and store brands from its SEC filings and related materials.

One example of the company’s alleged untruthfulness is a March 2023 conference call where the CFO stated that franchise royalty fees are expected to account for a greater percentage of XPOF’s revenue, over time. Yet, in December 2023, a Bloomberg Businessweek report stated that Xponential had misled many franchisees into a “financial nightmare.”

As per the lawsuit, by knowingly and recklessly misstating the financial standing of the company’s franchisees, Xponential caused XPOF stock to trade at artificially inflated prices.

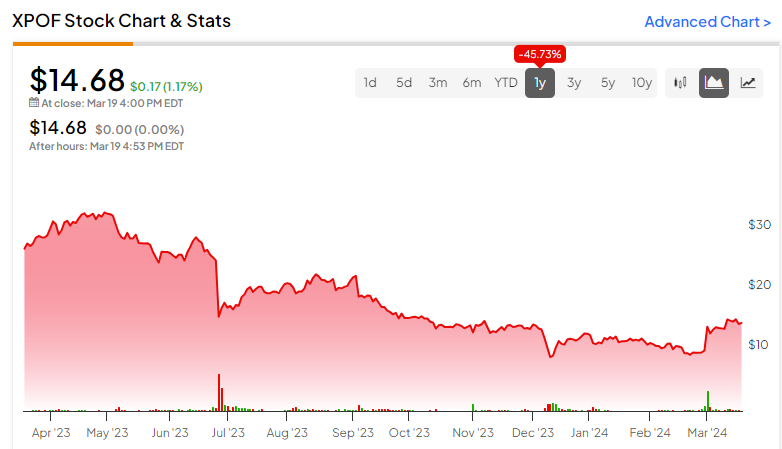

XPOF stock has dropped by 45.73% year-over-year.