Citi Research has become more cautious about the stock market and lowered its forecast for the S&P 500 (SPX). Indeed, the investment firm now expects the index to end the year at 5,800, which is down from its previous estimate of 6,500. It also cut its earnings-per-share estimate for the index from $270 to $255. Citi explained that this change is due to worries about the economy and weaker-than-expected company performances. With these risks rising, Citi believes that the market may struggle to keep climbing and has decided to take a more cautious approach.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nevertheless, even though Citi lowered its overall market outlook, it still sees solid potential in certain sectors. In fact, the firm kept an overweight rating on Information Technology (VGT), Communication Services (XLC), Health Care (XLV), and Financials (XLF) because these sectors are considered to be more stable and likely to perform better, even if the economy slows down.

However, Citi took a more cautious view on other parts of the market by downgrading Consumer Discretionary (XLY), Industrials (XLI), Consumer Staples (XLP), and Materials (XLB) to underweight. These sectors are seen as more vulnerable to challenges like inflation and falling demand, which could hurt earnings. As a result, Citi believes that investors should focus on stronger and more reliable sectors while being careful with areas that are more sensitive to economic pressure.

Is SPY a Buy Right Now?

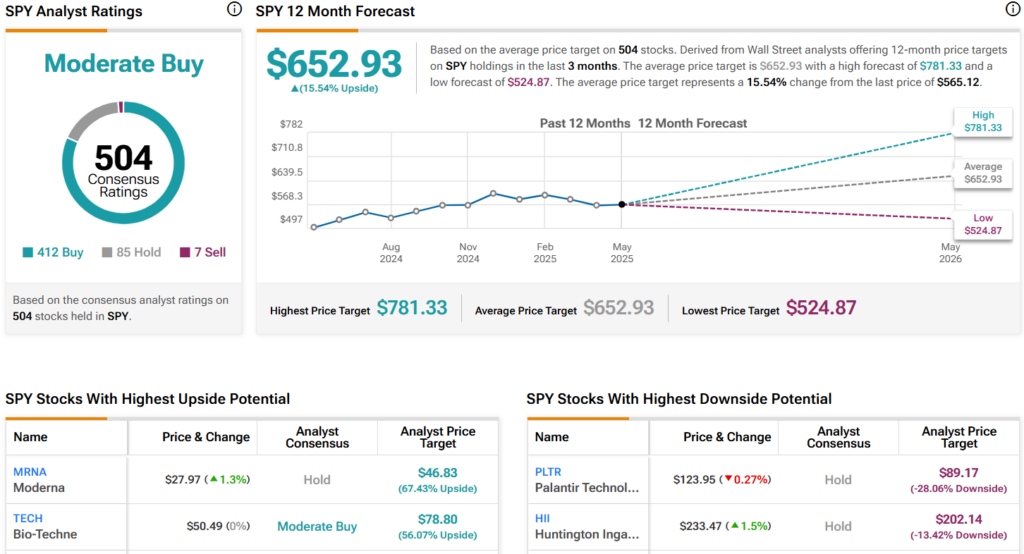

Turning to Wall Street, analysts have a Moderate Buy consensus rating on the SPDR S&P 500 ETF Trust (SPY) based on 412 Buys, 85 Holds, and seven Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average SPY price target of $652.93 per share implies 15.5% upside potential.