American Airlines (NASDAQ:AAL) gained in pre-market trading after top-rated Citi analyst Stephen Trent upgraded AAL to a Buy from a Hold and raised the price target to $20 from $14. The analyst’s price target implies an upside potential of 32.2% at current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Trent cited the airline’s diversified revenue streams and strong demand for its premium cabin services, giving it an advantage in the post-pandemic era. The analyst remained optimistic about American Airlines’ focus on reducing debt and its low capex. He also expects the airline major’s industry-wide capacity constraints to sustain its stock performance.

AAL had delivered better-than-expected results in the fourth quarter.

What Is the Future of AAL Stock?

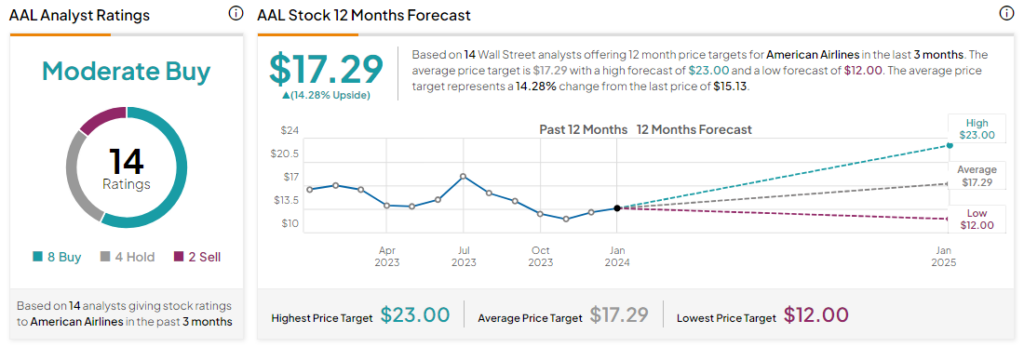

Analysts remain cautiously optimistic about AAL stock with a Moderate Buy consensus rating based on eight Buys, four Holds, and two Sells. Over the past year, AAL has slid by more than 5%, and the average AAL price target of $17.29 implies an upside potential of 14.3% at current levels.