Streaming giant Netflix (NASDAQ:NFLX) has been downgraded from Buy to Hold by top-rated Citi analyst Jason Bazinet. The analyst kept a price target of $500 on the stock, implying an upside potential of 3.1% at current levels.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Bazinet believes that Wall Street’s revenue estimates for the company may be too high and that Netflix’s content investments for next year could very well surpass Street expectations. Moreover, the analyst warned that potential acquisitions could not be ruled out.

As a result, the analyst also slashed his FY24 and FY25 earnings per share estimates to $14.65 from $15.47 and to $19.37 from $20.12, respectively.

What is the Stock Price Target for NFLX?

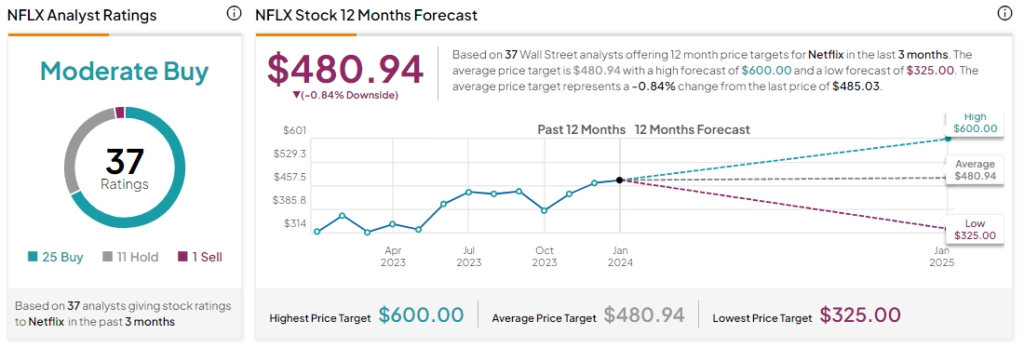

Analysts remain cautiously optimistic about NFLX stock with a Moderate Buy consensus rating based on 25 Buys, 11 Holds, and one Sell. NFLX stock has surged by more than 50% over the past year, and the average NFLX price target of $480.94 implies a downside potential of 0.8% at current levels.