Shares of Cintas Corporation (NASDAQ: CTAS) rose 2.5% on Thursday, reflecting the market’s reaction to the company’s upbeat results for the fourth quarter of Fiscal 2022 (ended May 31, 2022). Also, impressive projections for Fiscal 2023 (ending May 2023) boosted investors’ sentiments.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The last closing price of this $38.6-billion business services provider was $387.13. Cintas has expertise in making fire-resistant, first aid, uniforms, floor care, safety, and other products.

Revenue & Operating Results Aid CTAS’ Earnings

In the fourth quarter, Cintas reported earnings of $2.81 per share, roughly 4.9% above the consensus estimate of $2.68 per share. On a year-over-year basis, the bottom line increased 13.8%, driven by healthy demand for products and improvement in operating results.

Revenues were $2.07 billion in the quarter, up 3.5% from the consensus estimate of $2 billion. Organic sales grew 12.7% in the fourth quarter.

On a segmental basis, revenues of Uniform Rental and Facility Services expanded 11.1% year-over-year to $1.63 billion, and revenues of First Aid and Safety Services stood at $0.22 billion, up 16.7% from the year-ago quarter. Sales of All Other segment grew 24.4% to $0.23 billion.

Despite the increase in costs and expenses, the company’s operating income increased 13.5% year-over-year in the fourth quarter. The operating margin was 19.5% versus 19.4% in the year-ago quarter.

In Fiscal 2022, Cintas reported earnings of $11.65 per share, up 13.8% year-over-year. On an adjusted basis, earnings were $11.28 per share, reflecting growth of 10.2% from Fiscal 2021. Revenues at $7.85 billion were 10.4% above the year-ago tally.

Cintas’ President and CEO, Todd M. Schneider, said, “We achieved these great results by productively selling new business, penetrating existing customers with more products and services, providing excellent service, driving operational efficiencies, and obtaining price increases.”

CTAS’ Cash Position & Deployments

In Fiscal 2022, Cintas generated net cash of $1,537.6 million from its operating activities, up 13% year-over-year. However, its cash and cash equivalents at the end of the year were $90.5 million, down 81.7% from the previous year.

Of its available cash resources, the company used $240.7 million on capital expenditures, $164.2 million on acquisitions, and $1,200 million for repaying debts in Fiscal 2022. Debts (maturity more than a year) were up 51.2% year-over-year to $2,483.9 million at the end of Fiscal 2022.

Further, Cintas rewarded its shareholders with dividends of $375.1 million and share buybacks of $1,525.9 million.

Projections Underpin CTAS’ Growth Prospects

For Fiscal 2023, Cintas forecast revenues within the $8,470-$8,580 million range, suggesting a year-over-year increase of 7.8% to 9.2%. Earnings are forecast to be $11.90-$12.30 per share, up 5.5%-9% year-over-year.

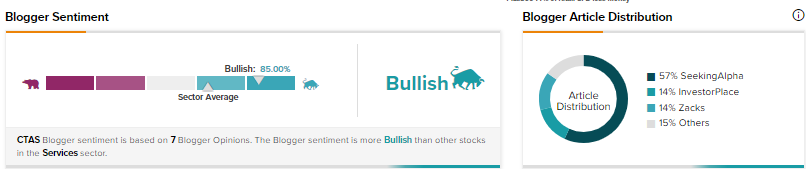

Analysts Cautiously Optimistic but Bloggers Bullish on CTAS

As per TipRanks, the Street is cautiously optimistic about Cintas and has a Moderate Buy consensus rating based on three Buys and three Holds. CTAS’ average price target of $425.67 suggests 9.96% upside potential from current levels.

Meanwhile, financial bloggers are 85% Bullish on CTAS, compared with the sector average of 65%.

Future Looks Bright for CTAS

The company’s fourth-quarter results are impressive. Going ahead, a solid product portfolio, excellent services, and a steady flow of demand from customers will continue to remain key drivers for Cintas. Also, its efforts to boost operational efficiency have been advantageous so far.

Read full Disclosure