The Department of Justice (DOJ) has sued health insurance company Cigna Corp. (NYSE:CI) for allegedly overcharging the U.S. Medicare Advantage Plans. Sources claim that Cigna has wrongfully shown its patients as sicker than they really are, and that diagnostic tests were not carried out.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The DOJ stated, “As alleged, CIGNA obtained tens of millions of dollars in Medicare funding by submitting to the Government false and invalid diagnoses for its Medicare Advantage plan members… This Office is dedicated to holding insurers accountable if they seek to manipulate the system and boost their profits by submitting false information to the Government.”

The Medicare Advantage Plan pays more to insurers under the “risk adjustment” category if the patients enrolled have higher “risk scores” owing to conditions including diabetes, heart disease, etc. This program provides insurers the incentive to accept sicker patients instead of focusing on healthier ones. However, insurers have found a loophole in the system and have overcharged the federal government under these plans.

Cigna has been alleged to have conducted malpractice, especially in its in-home treatments. The DOJ stated in its complaint that Cigna’s home visits “were designed to generate revenue for Cigna, not to provide medical care or treatment.” Cigna claimed that some of these in-house assisted patients were severely ill but never conducted an imaging or blood test to prove the diagnosis. Furthermore, the DOJ has stated that Cigna wrongfully claimed in its annual submissions that its reports were “accurate, complete, and truthful.”

The allegations against Cigna were first confronted by a whistleblower in 2020, but no action was taken then. Now, however, the DOJ has decided to double down on insurers who are illegally benefiting from the government’s medical programs.

Is Cigna a Good Stock to Buy?

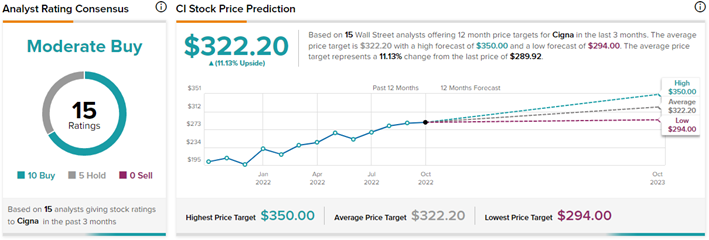

Wall Street analysts are split on Cigna’s stock trajectory. On TipRanks, CI stock has a Moderate Buy consensus rating based on ten Buys and five Holds. The average Cigna stock prediction of $322.20 implies 11.1% upside potential to current levels. Meanwhile, the stock has gained 25.4% so far this year.