Ciena Corp. reported lower-than-expected 4Q earnings and announced the resumption of it share repurchase plan. Shares of the telecommunication networking equipment and software services provider fell 2.3% on Thursday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Ciena’s (CIEN) adjusted earnings of $0.60 per share fell short of analysts’ expectations of $0.63 and compared to EPS of $0.58 in the year-ago period. Fourth-quarter revenues declined 14.4% to $828.5 million year-on-year, but surpassed Street estimates of $825.3 million.

“Our fiscal fourth quarter and full-year 2020 performance reported today demonstrates that we have the innovation, diversification and global scale to perform well in a challenging environment,” said Gary Smith, Ciena CEO.

Ciena announced that it will resume its share repurchase program in the first-quarter of fiscal 2021. The company has a buyback plan worth $150 million. (See CIEN stock analysis on TipRanks).

Following its earnings release, Needham analyst Alex Henderson reiterated his Buy rating and a price target of $58 (25.8% upside potential). In a note to investors, Henderson wrote, “We think the recovery will start in the Spring and accelerate as Huawei replacement and 800G drive share gains. We view this as a good time to enter CIEN shares in anticipation of these improvements.”

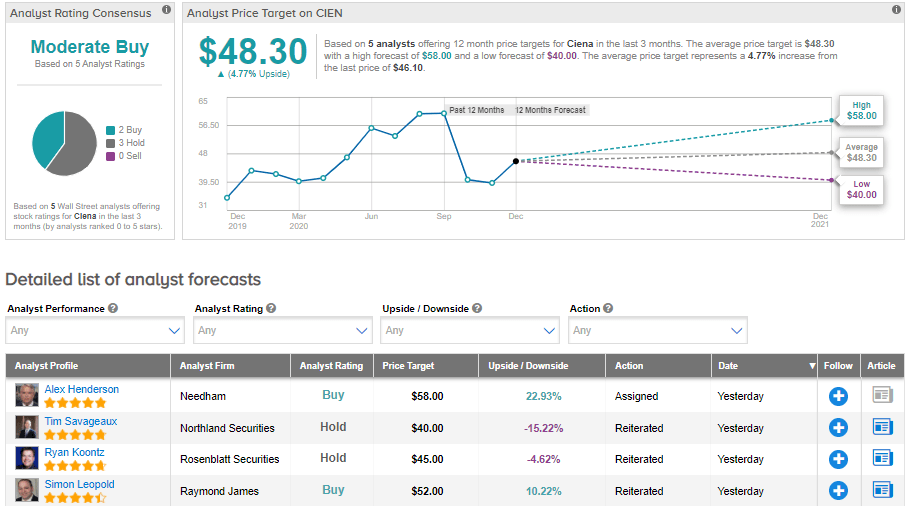

Meanwhile, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 2 Buys and 3 Holds. The average price target stands at $48.30 and implies upside potential of about 4.8% to current levels. Shares have plunged about 8% year-to-date.

Related News:

AT&T To Sell Crunchyroll To Sony For $1.18B; Morgan Stanley Says Buy

FireEye Sinks 13% After Cyberattack Hit; Citigroup Says Hold

Asana Spikes 16% On 3Q Beat, FY21 Guidance