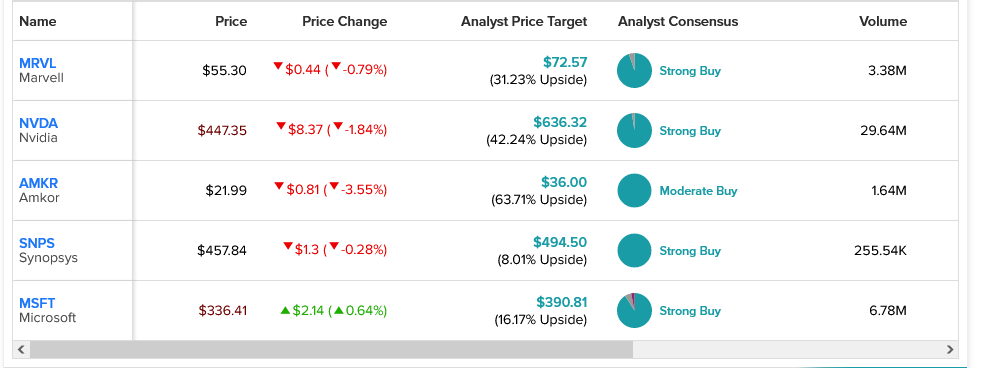

The Vietnam War lasted two decades, though the United States was only in on half of it. Even today, it’s a divisive subject. But there’s a whole new part of Vietnam that’s catching attention these days, and that’s its potential as a chip maker. Several companies have plans to do something in Vietnam, ranging from major household names like Microsoft (NASDAQ:MSFT) and Nvidia (NASDAQ:NVDA) to somewhat lesser names like Marvell (NASDAQ:MRVL), Amkor (NASDAQ:AMKR) and Synopsys (NASDAQ:SNPS). Nevertheless, chip stocks slumped at the time of writing.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Microsoft, for example, plans to connect with Vietnam’s Trusting Social to build a generative AI solution in the region. Nvidia, meanwhile, is teaming up with a coalition of Vietnamese firms to also make some new artificial intelligence moves, this time with a cloud focus.

Amkor plans a new factory for chips, Synopsys has a “design and incubation center” planned, and even Marvell showed up for the Vietnam-U.S. Innovation and Investment Summit. It’s bringing a whole new spirit to the tech sector, particularly for chip stocks.

Microsoft was the only chip stock to gain ground out of those listed today, even if the gains were fractional. It’s one of four Strong Buys on the list, and its $390.81 average price target gives it the second-lowest upside potential on the list at 16.17%. Meanwhile, the only Moderate Buy on the list, Amkor, offers the strongest upside potential of 63.71% with an average price target of $36.