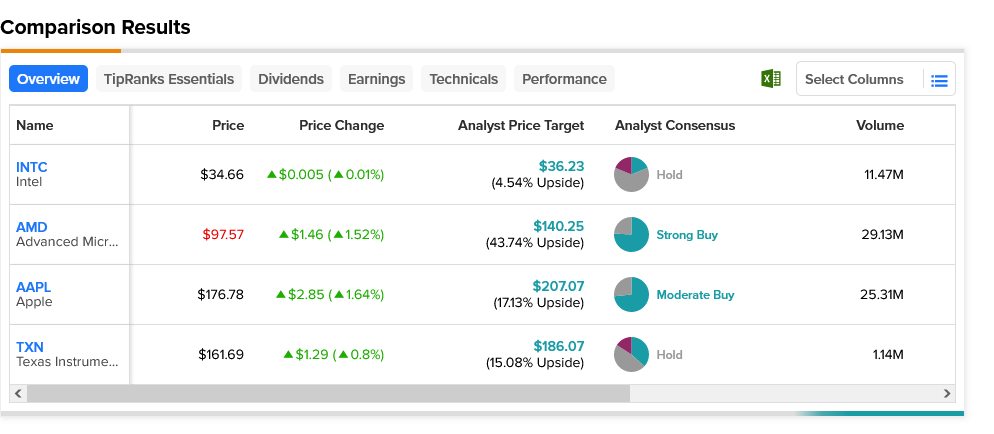

Chip stocks were surprisingly upbeat in Friday afternoon’s trading as the United States Commerce Department rolled out a new set of rules about how China can manage to get hold of certain breeds of chip. While it puts some limits on which companies can get federal funds, it also prevents expansion efforts in China. Intel (NASDAQ:INTC) wavered between fractionally up and down, AMD (NASDAQ:AMD) was up 1.5%, Apple (NASDAQ:AAPL) was up a little more than that at around 1.6%, and Texas Instruments (NASDAQ:TXN) was up fractionally as well.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Commerce Department put out the last rule, which ultimately sets up provisions of the CHIPS and Science Act known as “National security guardrails.” Said guardrails will forbid funding recipients from expanding manufacturing in “countries of concern” for the next 10 years and also keep those “countries of concern” out of any joint research or technology licensing efforts.

Getting America’s chipmakers up to snuff is a high priority, notes Gina Raimondo, Secretary of Commerce. Yet, at the same time, it was almost as vital to ensure that “…not a penny of this helps China to get ahead of us.” While it’s easy to wonder if the cow has left the barn already—particularly in light of the latest Huawei phone release—preventing any other leaks in the system should prove a useful pursuit. Though certainly, every chipmaker would love access to the massive Chinese market, there are some markets that are just too risky to pursue, no matter the reward.

Are Chip Stocks a Good Buy Right Now?

AMD stock is likely best placed to survive all this. It’s considered a Strong Buy, and thanks to its $140.25 average price target, boasts 43.74% upside potential. Intel, however, might be worst placed. This Hold-rated stock offers just 4.54% upside potential thanks to its $36.23 average price target.