A new analyst report can mean big things for the sector which it addresses. Chip stocks got their turn in the barrel today as Truist took aim at a few different stocks in the field. Some fared better than others as a result, and with second-quarter earnings season just around the corner, the end result made for an interesting Friday afternoon.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

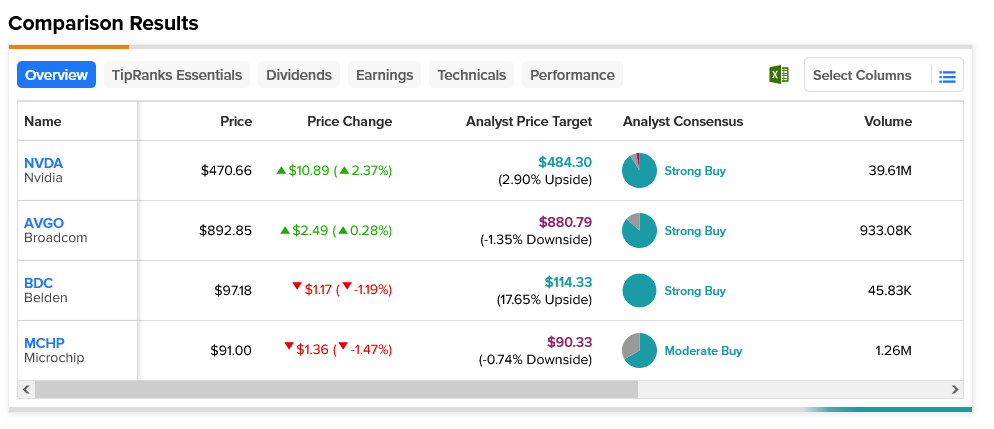

Truist analyst William Stein brought out a report featuring four names in the semiconductor space: powerhouse Nvidia (NASDAQ:NVDA), widely-known Broadcom (NASDAQ:AVGO) and both Belden (NYSE:BDC) and Microchip (NASDAQ:MCHP). Nvidia has been on a runaway upward track of late thanks to its new connection to AI, and the other three have enjoyed a certain amount of success in the interim.

Yet Stein’s report looks for significantly varied results among the four, thanks to “mixed” feedback from industry contacts. Specifically, of the four, only Nvidia and Broadcom are “requesting meaningful upsides.” Accordingly, Stein revised Nvidia’s full-year estimates up from $7.90 per share on $43.44 billion to $8.05 per share on $44.33 billion. Belden added too, going from $7.11 per share on $2.734 billion to $7.14 on $2.74 billion. Broadcom got a healthy notch up from $43.29 per share on $36.24 billion to $43.55 per share on $36.413 billion.

Nvida gained the most as of this writing, but it doesn’t have the biggest upside. That honor goes to second-biggest loser Belden, who counts as a Strong Buy, and has an upside potential of 17.65% thanks to its average price target of $114.33. Meanwhile, the second-biggest gainer, Broadcom, also has the worst downside risk. With an average price target of $880.79, this Strong Buy comes with a 1.35% downside risk.