Yesterday was not a great day for chip stocks, as Intel (NASDAQ:INTC) plunged after word that Sapphire Rapids would likely not be the big seller some had hoped for. However, today isn’t looking much better, either. Some of the biggest names in the chip sector are on the decline once more as another round of selling strikes.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Texas Instruments (NASDAQ:TXN) is scheduled to announce earnings today after the close. Consensus estimates call for $1.77 in earnings per share and $4.37 billion in revenue. Generally, Texas Instruments tends to exceed earnings and revenue estimates; it’s done so for the last eight quarters running.

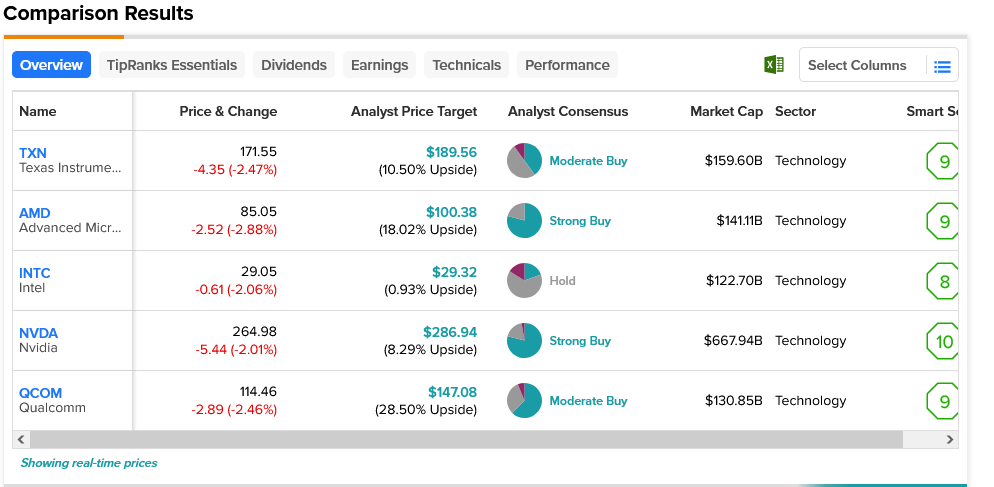

However, investors seem less sure that will be the case today, as Texas Instruments is down almost 2.5% at the time of writing, and it wasn’t alone. AMD (NASDAQ:AMD) slid nearly 2.9%, while Qualcomm (NASDAQ:QCOM) dropped 2.46%. Intel and Nvidia (NASDAQ:NVDA) got off the lightest, down 2.06% and 2.01%, respectively.

Of the aforementioned stocks, old competitors Intel and AMD fared the worst and best, respectively. Intel is considered a Hold by analyst consensus and offers a meager 0.93% upside potential thanks to its average price target of $29.32. However, AMD is considered a Strong Buy and offers 18.02% upside potential via its average price target of $100.38.