Tech stocks in China are uniquely set up for success or failure thanks to one key component: Beijing. When Beijing provides cash and incentives, stocks go up. When Beijing gets power-grabby, stocks go down. Today, Chinese tech stocks saw the full force of Beijing in power-grab mode as the sector saw a substantial plunge. Several major stocks, from Alibaba (NASDAQ:BABA) to JD.com (NASDAQ:JD) to Pinduoduo (NASDAQ:PDD) and NetEase (NASDAQ:NTES) were down. Bucking the trend, however, was Baidu (NASDAQ:BIDU), which notched up fractionally in the Wednesday afternoon session.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The latest power grab was actually a familiar one, as Beijing’s Cyberspace Administration of China offered up a set of proposals that basically put it in charge of artificial intelligence technology and development everywhere in China. The Administration wanted to be allowed to determine who would be able to offer AI services in China and would also be held responsible for any content the AI systems actually created.

Further rules were established to promote state power more than anything. AI content should “reflect the core values of socialism” and “should not subvert state power.” Companies were also expected to “train” AI models to make sure they do “…not discriminate against people based on things like ethnicity, race, and gender,” noted a CNBC report. Finally, they should also not “…generate false information,” which opens up a wonderful string of potential Catch-22s that ensure obeying one rule will lead to disobeying another.

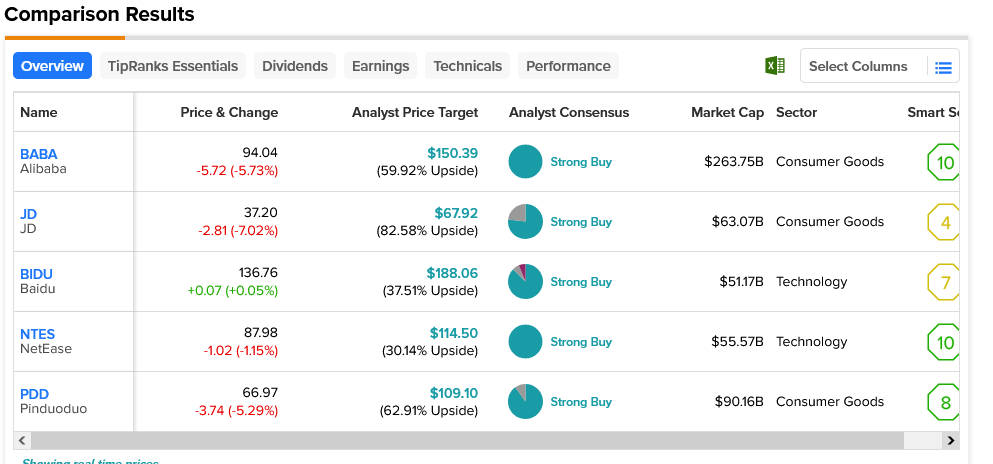

In Wednesday afternoon’s trading, Baidu was one of a bare handful of Chinese tech stocks that actually gained ground. It’s rated a Strong Buy by analyst consensus, and its average price target of $188.06 gives it 37.51% upside potential. Interestingly, it’s actually the second lowest in terms of upside potential, beaten only by NetEase. NetEase is also a Strong Buy by analyst consensus, but its $114.50 average price target gives it just a 30.14% upside potential.