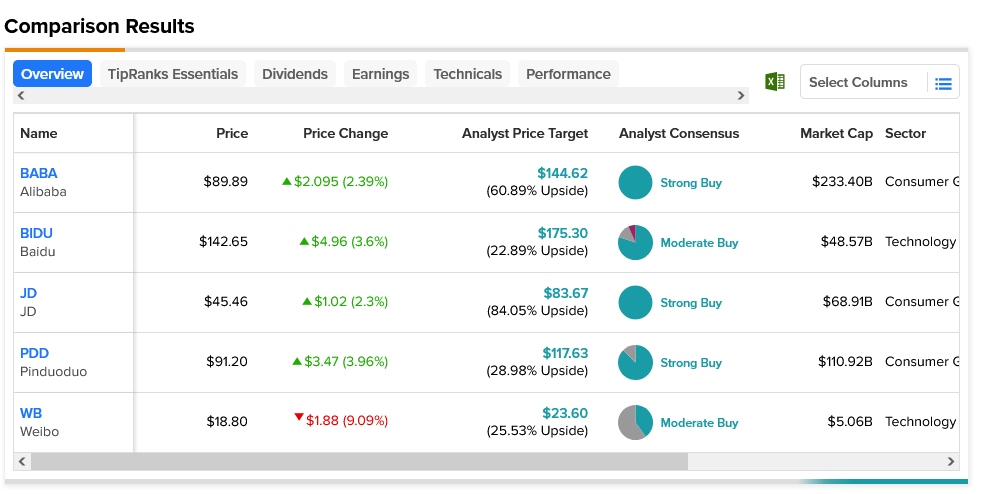

The biggest problem that Chinese stocks faced in the last several months was China itself. Or rather, the Chinese government, whose zero-COVID policies all but ensured economic disaster eventually. Now, stocks like Alibaba (NASDAQ:BABA) and Baidu (NASDAQ:BIDU) are making a clear comeback, and it’s all thanks to a lot fewer restrictions.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Data from the Chinese market shows a clear uptick in performance. The Chinese government’s official purchasing manager’s index showed a reading of 52.6. The more independent Caixin index, meanwhile, came in close to that at 51.6. Both numbers showed economic expansion, though slightly less so on the Caixin index.

Analysts, meanwhile, are weighing in positively all over. UBS Global Wealth Management’s Mark Haefele, chief investment officer, noted that data expected out in mid-March should ultimately confirm what’s already been seen: a recovery in progress. Meanwhile, Robert W. Baird analyst Colin Sebastian expects Alibaba stock to represent much of the Chinese economy, calling it “…a China recovery play.”

Today’s news about the various PMIs shows solid recovery for some of the biggest Chinese stocks. However, it’s not universal. While Pinduoduo’s gain was a clear sign, Weibo (NASDAQ:WB) fell on the same data. Yet among these, JD.com (NASDAQ:JD) is the most favored. Indeed, analyst consensus calls JD stock a Strong Buy with 84.05% upside potential thanks to its average price target of $83.67.