Chinese electric vehicle makers are expanding in Europe despite the European Union slapping new tariffs. In 2024, Chinese battery electric vehicles took over 20% of the EU market for fully electric cars. That growth came while most of those models were priced up to 40% below their European rivals.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In October 2024, the European Union raised trade duties on Chinese battery electric vehicles. Those duties reached as high as 35.3%, which came on top of the standard 10% car import tax. The goal was to slow the inflow of lower-cost electric cars from China. Still, the latest data shows that Chinese brands have kept growing in both volume and share.

BYD and SAIC Motor Find a Gap in the Policy

Meanwhile, many Chinese firms are now taking advantage of a gap in the policy. Plug-in hybrid models from China are only taxed at the 10% base rate. The extra duty does not cover that group of cars. As a result, companies like BYD (BYDDF) and SAIC Motor have shifted more supply to plug-in hybrids. In the first half of 2025, BYD registered more than 20,000 of those models in the EU, surpassing the full-year total from 2024 by over three times.

In parallel, Chinese automakers have raised their share of total passenger car sales in the region. In September 2025, their share reached 7.4% of the EU market, passing South Korean brands for the first time. According to market trackers, Chinese automakers held 10.7% of Western Europe’s electric vehicle sales in the first nine months of 2025.

Pressure Builds for EU Car Makers as Local Production Expands

European car makers now face more pressure on prices and plant use. Recent data shows that many car factories across Europe are running at about 55% of capacity. That is well below the level needed to stay efficient. The same report warned that Chinese car makers could cost European firms one to two million units of yearly sales.

Already, some European brands have paused production in parts of their networks. Volkswagen AG (VWAGY) halted work at some of its German electric vehicle plants in October 2024. Stellantis (STLA) also paused operations at six plants across the region in recent months.

Still, European Union countries are not fully aligned on how to respond. Germany did not support the duties due to concerns about sales risk in China. More than 30% of German car exports go to China. On the other hand, France and Italy have pushed for stricter rules to protect jobs at home.

At the same time, Chinese firms have started to invest in local production to avoid trade costs. BYD Company is building a factory in Hungary, set to start production in 2026. The site plans to reach 300,000 cars per year.

What Investors May Watch Next

TipRanks readers can keep an eye on three things. First, Chinese brands may keep growing in Europe. Second, European car makers may adjust plants and plans. Third, new trade rules could change how both groups compete. Prices, jobs, and policy will stay important for auto stocks.

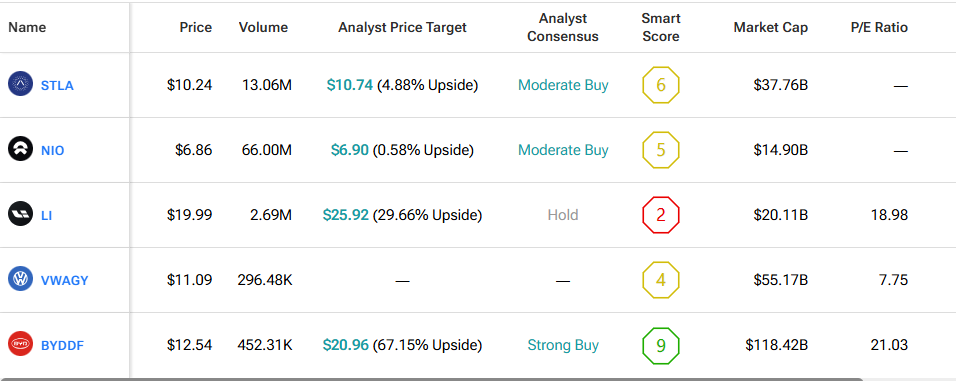

By using TipRanks’ Comparison Tool, we’ve lined up all the major auto manufacturers side by side. It’s a great way for investors to gain a wider look at each of the stocks and the auto industry as a whole.