Aerospace firm Boeing (BA) has not had a good run of things for the last several months now. However, there are still some positive signs out there, particularly in terms of its shipments to China. In fact, this news was sufficiently good to light a fire under Boeing shares and send them up nearly 2% in Wednesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Boeing managed to clear a milestone recently, as Bloomberg noted that it shipped more 737 MAX jets to China now than it has at any point in the last six years. While the production cap Boeing currently operates under by federal mandate is limiting its ability to produce and thus meet orders, its stockpile of finished products is certainly helping.

Meanwhile, a potential engineer and machinist strike will not help at all. Thus, Boeing is a bit under the gun here to not only clear its decks but also get more products built to help clear its future backlog.

MIT Says Flying Has Never Been Safer

Meanwhile, the idea of getting on an airplane might be a little unnerving these days, especially when you consider how much news you have heard about parts of the aircraft reaching your destination before you do. That is where a new study from MIT is stepping in and, potentially, restoring some faith in air travel.

With around 20% of travelers now checking to see if they will be flying on a Boeing plane and another 22% reducing traveling altogether, the MIT study noted that the risk of dying on a commercial flight is now down to one in 13.7 million across 2018 to 2022. That’s significantly better than the one in 350,000 seen back in 1968 to 1977. And the metric has only improved; from 2007 to 2017, it was one in 7.9 million, while from 1998 to 2007, it was one in 2.7 million.

Is Boeing a Buy, Sell, or Hold?

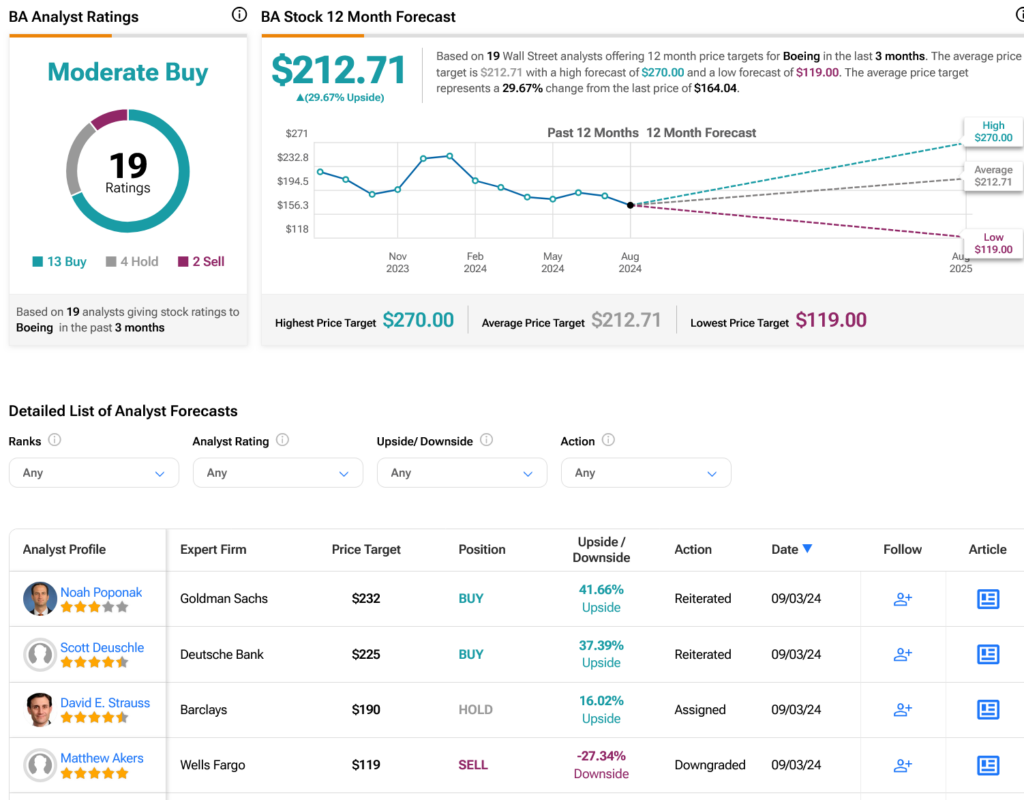

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 13 Buys, four Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 26.42% loss in its share price over the past year, the average BA price target of $212.71 per share implies 29.67% upside potential.