China’s leading memory chipmaker, ChangXin Memory Technologies (CXMT), is preparing an initial public offering in Shanghai that could value the company at up to $42 billion. This is according to a report by Reuters. The listing could take place as early as the first quarter of next year. CXMT plans to raise between $20 billion and $40 billion, with China International Capital Corporation and CSC Financial advising on the deal. Founded in 2016 with government backing, CXMT plays a key role in China’s plan to build a homegrown semiconductor industry and reduce its reliance on foreign chipmakers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Growing Competition in the Memory Market

CXMT’s move comes as the global market for memory chips is heating up. Its offering would follow a strong rally in Chinese semiconductor stocks, which have risen about 49% this year. Many domestic investors see the company as a symbol of China’s progress toward self-reliance in technology.

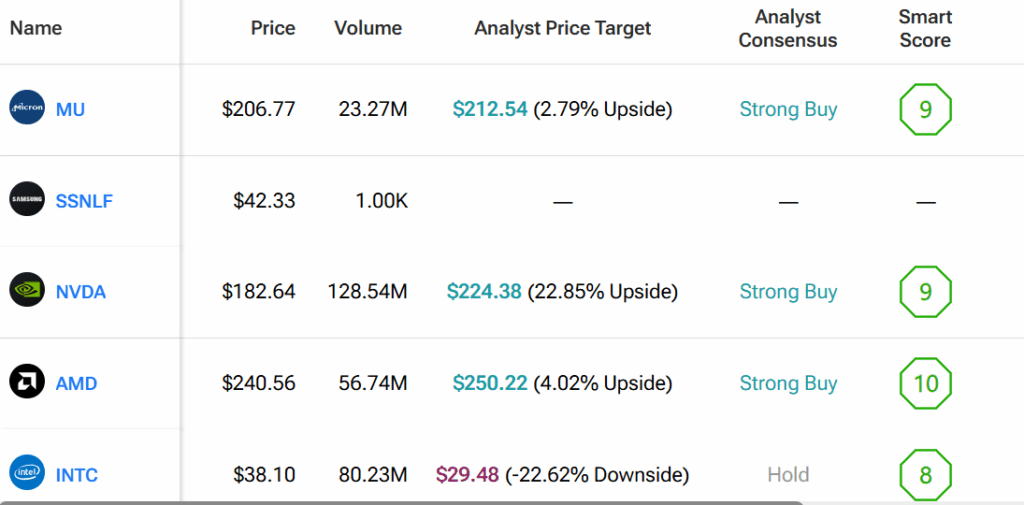

At the same time, CXMT is investing heavily to close the gap with top memory producers. These include Samsung Electronics (SSNLF) and SK Hynix, both of South Korea, and Micron Technology (MU) in the U.S. CXMT plans to start producing high-bandwidth memory, or HBM, by 2026. This type of chip is used in advanced graphics processors such as those made by Nvidia (NVDA).

However, the company remains several years behind its South Korean rivals. SK Hynix expects to begin large-scale production of its next-generation HBM4 chips by the end of this year. In contrast, CXMT’s early output will be smaller, and analysts expect its products to use older technology nodes.

Market Shifts and Global Effects

Still, the timing works in CXMT’s favor. The global push for AI hardware has increased demand for memory used in data centers and high-performance computers. This surge has lifted chip prices and improved profit margins for existing players. As new supply comes online, though, prices could ease. Analysts say CXMT’s entry might eventually lower costs for companies that rely on memory chips, including Nvidia, Advanced Micro Devices (AMD), and Intel Corporation (INTC).

Meanwhile, Micron Technology has been scaling back its presence in China after local regulators restricted its products in sensitive infrastructure. CXMT could fill that gap by supplying domestic cloud and server firms that prefer local vendors.

A Fourth Major Player

For now, the global memory market is dominated by Samsung, SK Hynix, and Micron. CXMT’s rise could turn that trio into a group of four. The company’s growing capacity and government support give it a long runway, even if its technology lags behind.

As a result, investors will be watching this IPO closely. It may become one of China’s largest tech listings in 2026 and could mark a new phase in the global competition for semiconductor leadership.

By using TipRanks’ Comparison Tool, we’ve lined up all the major chipmakers in the industry to gain a broader perspective on each of the stocks and the chip industry as a whole.