Does anyone remember the story of King Canute? This Danish king is perhaps best remembered for apocryphal stories about how his power was insufficient to order the tide to turn back. That’s perhaps a lesson for China as it places sanctions against Lockheed Martin (NYSE:LMT) and Northrup Grumman (NYSE:NOC) for daring to sell weapons to Taiwan. Investors, meanwhile, are largely unfazed, with both down fractionally in Friday afternoon’s trading.

The sanctions come as part of China’s Anti-Foreign Sanctions Law. China, meanwhile, called on the United States to “…earnestly abide by the one-China principle and the stipulations of the three China-U.S joint communiques, stop arms sales to Taiwan, stop military collusion with Taiwan and stop arming Taiwan; otherwise, it will be met with China’s resolute response.” The remarks come at an interesting time, too; only last week, China apparently “apprehended” the country’s Defense Minister, Li Shangfu.

China also warned of “forceful retaliation” over such moves. Meanwhile, China’s Anti-Foreign Sanctions Act here is at least somewhat at loggerheads with the United States’ Taiwan Relations Act, which requires weapons to be supplied to Taiwan for the sake of its own defense. Presumably, one of the three “joint communiques” mentioned covers this. Lockheed Martin does do some business in China, supplying air traffic equipment as well as commercial helicopters. Northrup Grumman, meanwhile, has a somewhat less known amount of business in China, but some reports already call the sanctions “symbolic.”

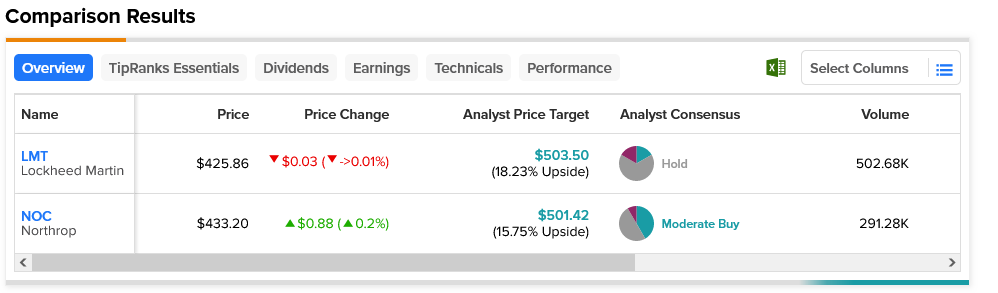

Lockheed Martin and Northrup stocks behaved similarly in the face of China’s sanctions, and that’s not where the similarities end, either. Lockheed is considered a Hold by analysts, while Northrup is a Moderate Buy. Both offer similar upside potentials as well; Northrup’s is 15.75% on a $501.42 average price target, while Lockheed Martin’s is 18.23% on a $503.50 average price target.