Oil giant Chevron (NYSE:CVX) slipped in pre-market trading after the company reported earnings for its third quarter of Fiscal Year 2023. The company’s adjusted earnings came in at $3.05 per share compared to $5.56 per share in the same period last year. This missed analysts’ consensus estimate of $3.70 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company’s earnings declined due to “lower upstream realizations and lower margins on refined product sales.” Chevron’s upstream earnings fell by 38% year-over-year to $5.8 billion in the quarter.

Sales declined by 18.3% year-over-year to $51.9 billion but were above analysts’ expectations of $51.4 billion. The company’s sales were impacted due to lower oil prices.

Chevron declared a quarterly dividend of $1.51 per share, payable December 11, to all holders of common stock on record at the close of business on November 17.

Is CVX a Buy, Hold, or Sell?

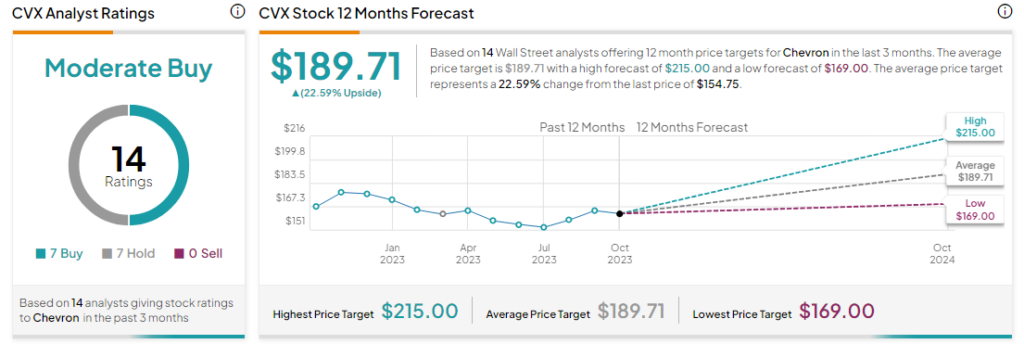

Analysts are cautiously optimistic about CVX stock, with a Moderate Buy consensus rating based on seven Buys and Holds each. The average CVX price target of $189.71 implies an upside potential of 22.6% at current levels.