Chevron (NYSE:CVX) expects capital expenditure (capex) of $17 billion in 2023, which is at the high end of its guidance range of $15 billion to $17 billion and marks a 25% increase from the 2022 capex estimate, excluding acquisitions. Chevron is boosting its capex amid criticism from President Joe Biden, who slammed energy giants for using their record profits to pay hefty dividends instead of increasing production and bringing down oil prices.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The 2023 capex budget includes $11.5 billion of upstream expenditure, $1.9 billion of downstream spending, and $0.6 billion of other expenditure. About $3 billion of the capital budget is meant for equity affiliates. It’s worth noting that more than $4 billion of upstream capex will be used for Permian Basin development.

Chevron’s 2023 capex will be directed toward both traditional and new energy sources. The company intends to invest $2 billion in lower carbon energy businesses across all its segments, which is more than double the 2022 budget.

Meanwhile, the Biden administration recently granted Chevron the license to restart its oil operations in Venezuela after the South American country’s government agreed to hold talks with the opposition. On Wednesday, Venezuelan officials and Chevron’s executives held a private meeting to discuss operations and management, Reuters reported, citing people familiar with the matter.

Is Chevron a Buy, Sell, or Hold?

Chevron stock has surged 47% so far this year as the Russia-Ukraine war triggered a rise in energy prices. The company delivered upbeat third-quarter earnings amid a favorable backdrop for oil and gas companies.

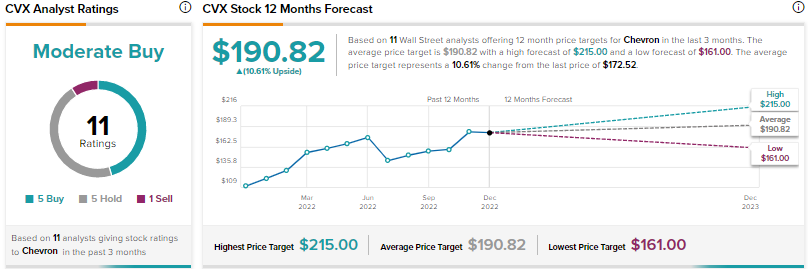

Wall Street is cautiously optimistic about Chevron stock due to demand concerns amid growing fears of a recession. The Moderate Buy consensus rating for Chevron is based on five Buys, five Holds, and one Sell rating. The average CVX price target of $190.82 implies 10.6% upside potential.