Energy giant Chevron (NYSE:CVX) is caught in the ongoing Israel-Hamas war’s crossfire, as the Israeli government has ordered the company to temporarily suspend production at the Tamar gas field. Israel’s energy ministry said that the country is gearing up to use alternative fuels to power its stations. This development could push natural gas prices higher.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Shutdown of Chevron’s Tamar Platform

The Tamar gas field is about 15 miles off Israel’s southern coast and is within the range of rocket fire from the Gaza Strip, which explains the government’s move to shut down the gas field for safety reasons. It is a major source of natural gas to power the country’s electric grid and industries. As per Chevron, Tamar supplies 70% of Israel’s energy consumption needs for power generation. Also, some of Tamar’s gas is exported to Jordan and Egypt.

Meanwhile, the Leviathan platform, the other major offshore gas facility operated by Chevron, will continue to supply gas to Israel and elsewhere for export. Chevron gained the rights to operate the Tamar and Leviathan gas fields through its $5 billion acquisition of Noble Energy in 2020.

The suspension of production at the Tamar field is expected to have a small impact on Chevron’s profits due to the recent surge in energy prices. However, it highlights the risks associated with the company’s strategy to expand its natural gas production capacity in the region.

The disruption of Russian gas supplies to Europe made Chevron and its peers look for gas fields in other regions. If the ongoing conflict in the Middle East worsens, it could impact supplies and further boost energy prices.

Is CVX a Buy, Hold, or Sell?

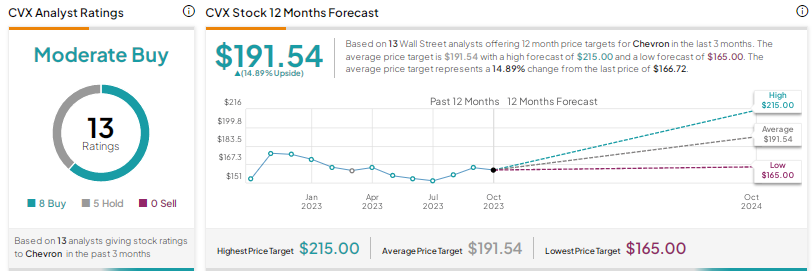

Wall Street’s Moderate Buy consensus rating on Chevron stock is based on eight Buys and five Holds. The average price target of $191.54 implies about 15% upside potential. Shares have declined 7% year-to-date.

Investors should note that Wolfe Research’s Sam Margolin is the most accurate analyst for CVX stock, according to TipRanks. Copying the analyst’s trades on CVX and holding each position for one year could result in 89% of your transactions generating a profit, with an average return of about 11% per trade.