Edtech company Chegg (NYSE:CHGG) trended lower in pre-market trading after Morgan Stanley analyst Josh Baer downgraded the stock from Hold to Sell and lowered the price target to $9 from $10. Baer’s price target is the lowest on the Street and implies a downside potential of 13.96% at current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The analyst cited weaker third-party data and an “aggressive” outlook when it comes to Q4 subscriber additions. Baer also pointed out the tough competition the company faces from generative artificial intelligence. The analyst warned that this will likely result in negative consensus estimate revisions for 2024 and 2025.

Is Chegg Stock a Good Buy?

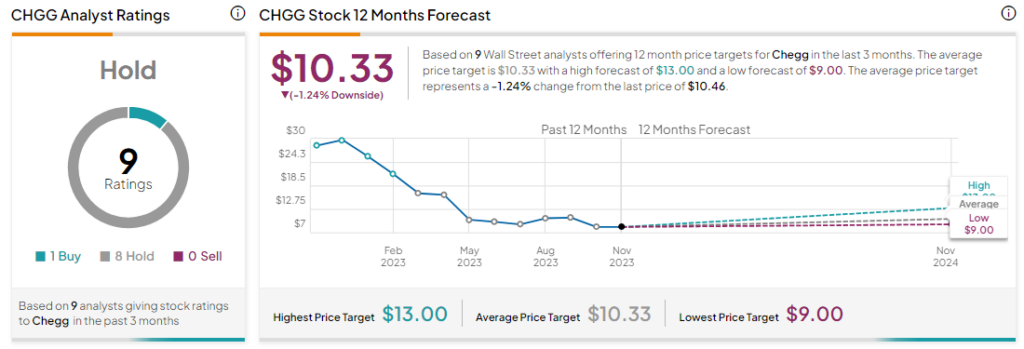

Analysts remain sidelined about Chegg stock with a Hold consensus rating based on one Buy and eight Holds. Chegg stock has dropped by more than 50% year-to-date and even the average Chegg price target of $10.33 implies a downside potential of 1.2% at current levels.