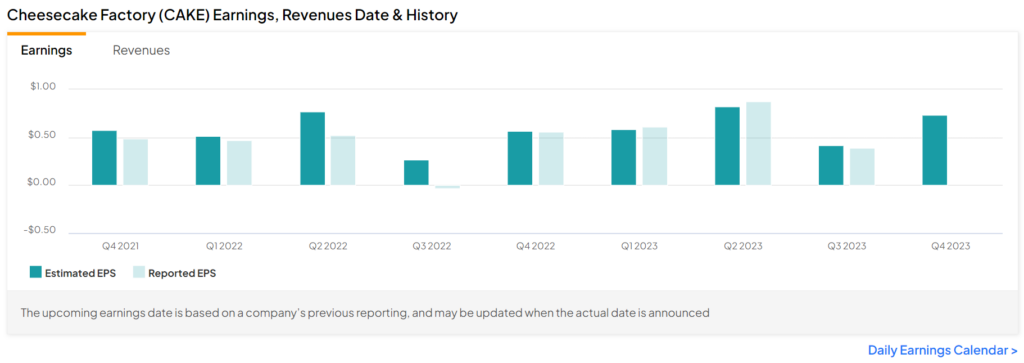

Earnings season is upon us, and all eyes will be on The Cheesecake Factory Incorporated (NASDAQ:CAKE), when it reports its fourth-quarter earnings after market close on February 21. Despite missing earnings estimates last quarter (reported EPS of $0.39 on consensus estimate of $0.42), earnings have been higher when compared to the previous 12-month period. Case in point – the consensus EPS forecast of $0.73 for Q4 2023 marks an improvement from the prior-year quarter’s EPS of $0.56.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Sweet Story Driving CAKE Stock

When David Overton launched the first Cheesecake Factory restaurant in Beverly Hills, California, in 1978 to sell his mom’s delicious cheesecakes (among a few other items), he may not have envisioned what the company would grow into. Today, the Cheesecake Factory sells roughly 35 million slices of cheesecake every year, on top of a massive menu over 20 pages long and containing 250 items.

Sales of all that cheesecake (and other menu items) resulted in fairly predictable earnings and revenue leading into 2020. COVID, however, derailed the company’s sales. Nonetheless, Cheesecake has fought its way back from a challenging environment and down year in 2020.

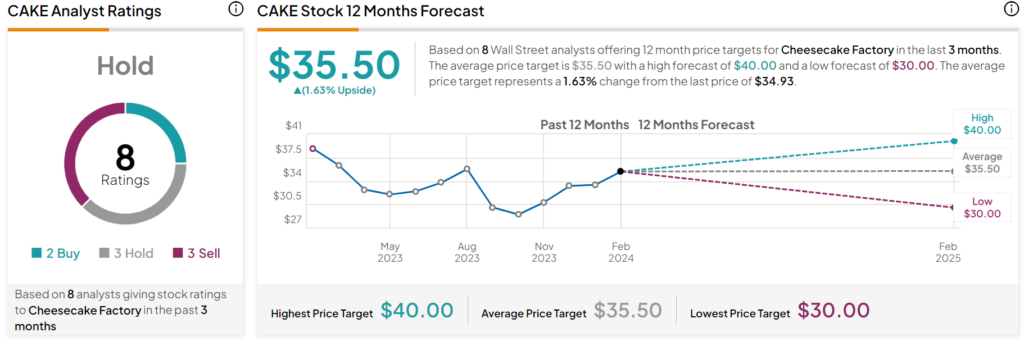

Since then, Wall Street analysts have been split on the stock. CAKE has received 2 Buy ratings, 3 Hold ratings, and 3 Sell recommendations in the past month.

The recent note from Citi analyst Jon Tower is symbolic of the challenge rating CAKE stock. Citi raised its price target for Cheesecake Factory stock to $37 from $34, saying that the company should be relatively well positioned in the current macro backdrop, given that it has less exposure to customers in the lower-income bracket. That said, Citi maintained a Hold rating on the shares partly based on concerns about the company’s execution in a less predictable week-to-week sales environment.

What is the Target Price for CAKE Stock?

CAKE currently has a HOLD consensus rating based on the recommendations of eight Wall Street analysts who have reviewed the stock in the past three months. The average price target is $35.50, with analysts’ forecasts ranging from $30 to $40. The average price target represents a 1.63% change from the previous closing price of $34.93.

Last Course

The Cheesecake Factory is an example of the restaurant industry’s resilience in the face of adversity. Bouncing back from the impact of the pandemic, the company is on track for potential growth, with Wall Street analysts closely watching its performance. While the past few years have seen sales volatility, the signature cheesecake and vast menu continue to drive earnings. The question facing investors is if the sweetness of success will continue to stick with CAKE, at least for this earnings cycle.