OpenAI, the company behind ChatGPT, has reportedly reached a staggering $500 billion valuation, overtaking Elon Musk’s SpaceX (PC:SPXEX). This transaction pushed OpenAI’s valuation well past its previous $300 billion level, earlier set during a SoftBank (SFTBY)-led financing round. The milestone comes after a share sale involving current and former employees, reflecting strong investor confidence in the company’s AI-driven growth.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The deal pushes OpenAI’s valuation beyond SpaceX’s $400 billion mark, making it one of the most valuable private tech companies in the world.

OpenAI Reaches $500B Valuation

OpenAI reached a $500 billion valuation following a share sale by its employees. According to Reuters, current and former OpenAI employees sold approximately $6.6 billion in stock to outside investors, including Thrive Capital, SoftBank, Dragoneer Investment Group, Abu Dhabi’s MGX, and T. Rowe Price (TROW). The sources added that the company had approved the sale of over $10 billion worth of stock on the secondary market.

For context, an employee stock sale, also called a secondary sale, happens when current or former employees sell their shares to outside investors. In this case, the company doesn’t get the money—employees and early investors do.

OpenAI’s Rapid Growth

OpenAI’s offerings, from ChatGPT to enterprise AI solutions, are experiencing surging demand. According to new filings, OpenAI generated roughly $4.3 billion in revenue during the first half of 2025. That figure is 16% more than the firm generated in all of 2024. The sharp rise shows how investors are rushing to back technology companies that could reshape industries.

Although the U.S. startup has yet to turn a profit, it is fueling this infrastructure boom through mega-deals with companies like Oracle (ORCL) and Nvidia (NVDA).

To sustain this growth, OpenAI must continue investing heavily in infrastructure, talent, and expanded operations. Therefore, any new investments will play a critical role in meeting huge demand and ensuring OpenAI maintains its leading position.

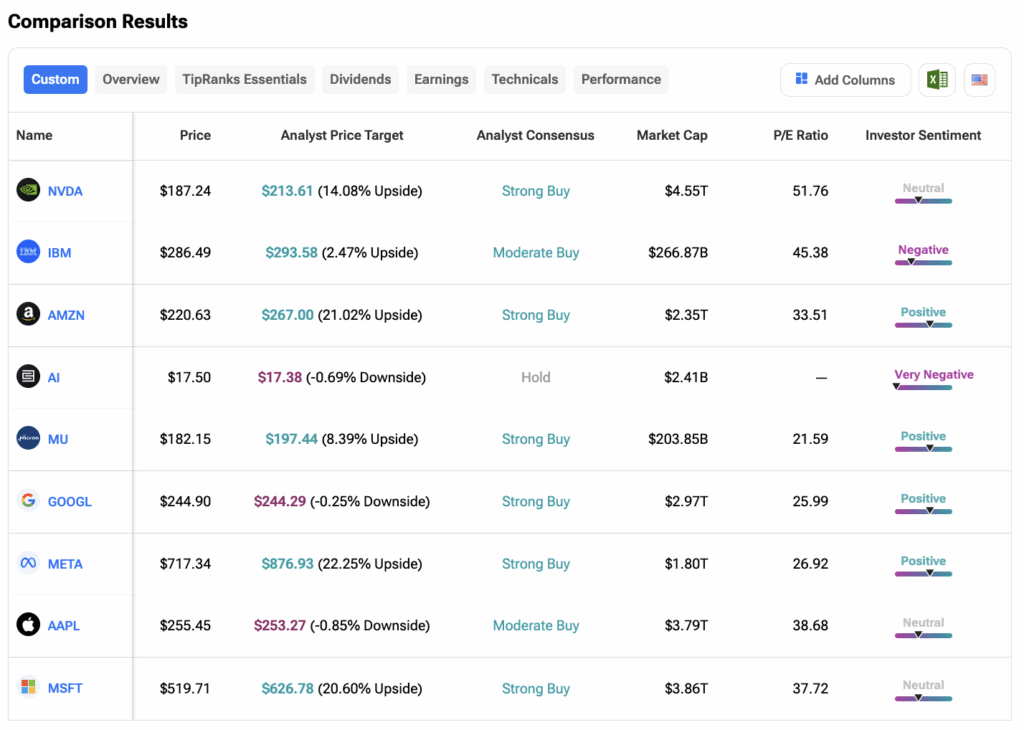

Which Is the Best AI Stock to Buy, According to Analysts?

Investors looking to buy into OpenAI in 2025 may be disappointed, as the company is still private and not publicly traded.

However, those interested in the AI sector can explore other leading AI-related stocks. Using TipRanks’ stock comparison tool, investors can compare top AI companies and conduct further research to find the most promising options based on analyst ratings and insights.