The Charles Schwab Corp. (NYSE: SCHW) announced record adjusted quarterly earnings in the third quarter of $1.10 per share, exceeding consensus estimates of $1.05 per share.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The financial services provider’s revenues went up 20% year-over-year in Q3 to $5.5 billion beating Street estimates by $80 million.

Co-Chairman and CEO Walt Bettinger commented that record Q3 retail inflows bolstered Schwab’s core net new assets which equaled $115 billion, an annualized growth rate of 7%.

Bettinger added, “Total client assets were $6.6 trillion at quarter-end, down 13% from a year ago, as robust asset gathering was more than offset by the $1.4 trillion impact of lower market valuations on client portfolios over the past 12 months. At the same time, our success in attracting and retaining clients supported a 4% year-over-year rise in active brokerage accounts – we ended the quarter at approximately 34 million.”

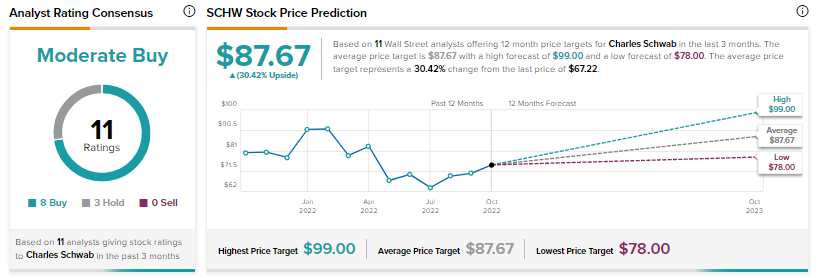

Is Charles Schwab a Good Stock to Buy?

Analysts remain cautiously optimistic about SCHW stock with a Moderate Buy consensus rating based on eight Buys and three Holds. The average price forecast for SCHW stock is $87.67 implying an upside potential of 30.4% at current levels.