The CEO of global e-Commerce giant Amazon (NASDAQ:AMZN), Andrew Jassy, remains upbeat about the company’s future despite the present challenging macroeconomic environment. In his annual letter to investors, the CEO noted that AWS now generates $85 billion in revenue but is still early in the adoption curve, and its new customer pipeline remains robust.

Amazon continues to look far ahead and plan for the future, and the company’s AWS teams remain focused on helping customers optimize spending. In addition, the company’s cloud computing team has whipped up some fresh AI tools for users to get their hands on. Dubbed “Bedrock,” this suite of tools lets customers tap into foundation models crafted by cutting-edge AI startups. Mixing these models with their own data, clients can create tailor-made solutions as needed without the hassle of investing in servers.

Further, Jassy added that grocery and advertising are two areas of brisk growth, with advertising witnessing growth despite a worldwide decrease in advertising spending. Moreover, the company is expected to emerge stronger from the current environment as global consumer sentiment recovers.

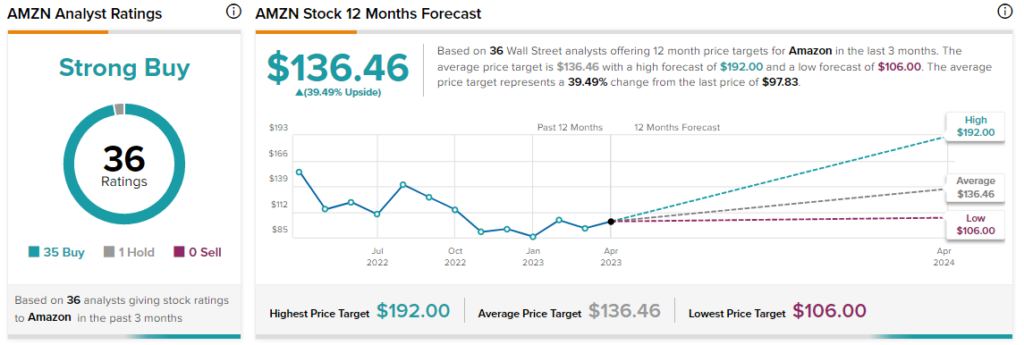

Overall, the Street has a $136.46 consensus price target on AMZN. This points to a 39.49% potential upside in the stock. That’s on top of a 10% climb in AMZN shares over the past month.

Read full Disclosure