British Gas owner Centrica (GB:CNA) has decided against a takeover of failed energy supplier Bulb, leaving just two companies competing for ownership.

Bids for Bulb (and its more than 1.5 million customers) are due to conclude by Thursday, with the firm having been run by administrators Teneo since collapsing in November, and paid for by the British taxpayer.

View from the City

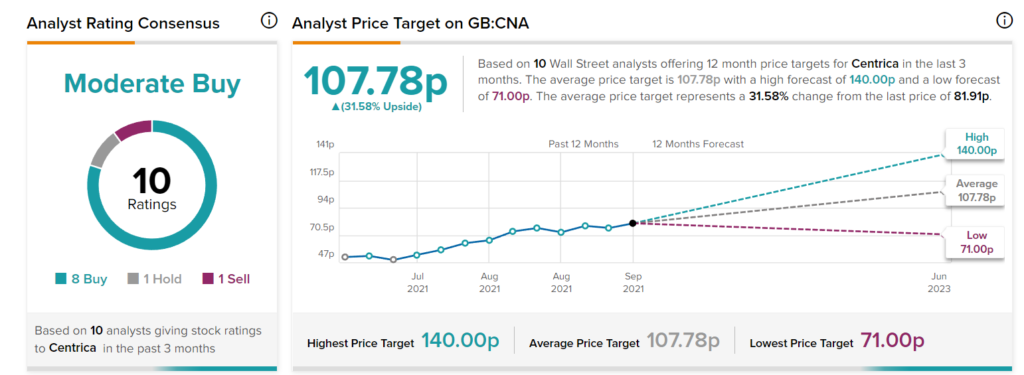

According to TipRanks’ analyst rating consensus, Centrica stock comes in as a Moderate Buy.

Out of 10 analyst ratings, there are eight Buy recommendations, one Hold recommendation and one Sell recommendation.

The average Starbucks price target is 107.78p, implying an upside of 30.04%. Analyst price targets range from a low of 71.00p per share to a high of 141.00p per share.

The Financial Times reported that Centrica has pulled out of the bidding processes, while two sources told the Times it had not yet formally withdrawn but would not submit a bid.

Two bidders left

The withdrawal was seen as a setback for the UK Government, which had hoped bidders would be willing to take on some of the company’s liabilities.

Bidders are expected to include Octopus Energy (ORIT) and the state-owned renewables group Masdar from the United Arab Emirates.

Financial newspaper City A.M. suggests the two groups may offer a joint bid, or that the privately-backed OVO Energy could submit a bid.

Bulb Energy was the biggest British victim of the energy industry crisis, which saw multiple energy companies cease trading. Bulb entered into administration in November 2021.

Once an innovator

The company had launched in 2015, and was hailed as an innovator in the space.

Since November 2021, it has been sustained by public money, which could total up to £2.2 billion.

Parliament’s spending watchdog the National Audit Office said in a report earlier this month that energy watchdog Ofgem’s approach to licensing suppliers had “increased risk”.

The NAO wrote, “By allowing many suppliers to enter the market and operate with weak financial resilience, and by failing to imagine a scenario in which there could be sustained volatility in energy prices, it allowed a market to develop that was vulnerable to large-scale shocks, and where the risk largely rested with consumers, who would pick up the costs in the event of failure.”

Centrica has a Smart Score of nine, based on analyst forecasts and other factors, and is predicted to outperform the market.