Cathie Wood’s ARK Investment Management made notable moves on May 8, boosting its position in Shopify (SHOP) following the company’s Q1 2025 earnings release. On Thursday, ARK acquired 228,824 shares of Shopify across its ARKF, ARKK, and ARKW ETFs, totaling approximately $21.6 million. ARK’s decision to buy more shares reflects its continued confidence in the e-commerce software firm, even as the broader market weighs on Shopify’s profit outlook for Q2.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Let’s dive into Shopify’s latest earnings results and how Wall Street analysts are interpreting the numbers.

Q1 Earnings Snapshot

Shopify reported $2.36 billion in revenue for Q1, reflecting a 27% year-over-year increase, slightly surpassing its forecast. Additionally, gross profit rose 22% to $1.1 billion, exceeding expectations. However, gross merchandise volume (GMV) came in at $74.75 billion, up 22% from Q1 2024, but fell short of analysts’ $76.09 billion estimate.

Looking ahead, Shopify offered a more cautious outlook for the second quarter, citing the impact of the ongoing U.S. trade dispute on its merchant base. It expects gross profit to grow in the high-teens percentage range, falling short of analysts’ 20.2% forecast. However, the company sees revenue growing in the mid-twenties range, slightly ahead of the average estimate of 22.4%.

Analyst Reactions Remain Mixed Following Q1 Results

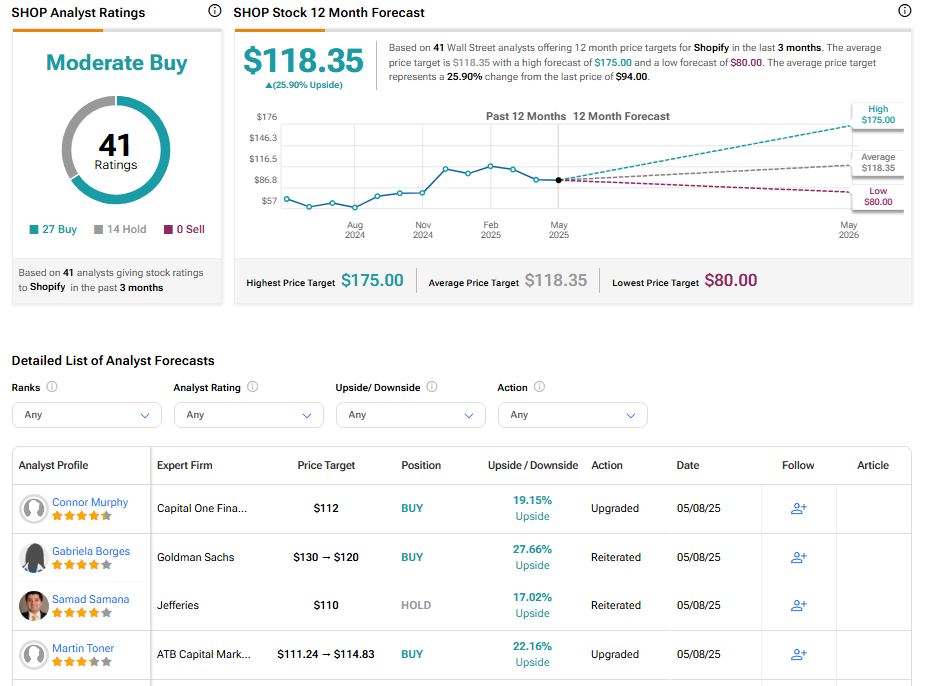

Goldman Sachs analyst Gabriela acknowledged Shopify’s solid Q1 performance and maintained a Buy rating, though she lowered the price target to $120 from $130. Borges highlighted Shopify’s continued market share gains, pointing to its strong GMV compared to overall U.S. e-commerce. She believes the company is well-positioned to expand even if broader industry growth slows.

Meanwhile, Jefferies analyst Samad Samana maintained a Hold rating on the stock with a price target of $110 per share. Samana also noted solid execution in Q1 but said the stock could remain range-bound in the near term. He contends that tariff-related uncertainty and softer margin guidance for Q2 are likely to cap further upside.

Is SHOP a Good Stock to Buy?

Overall, Wall Street has a Moderate Buy rating on SHOP stock, based on 27 Buys and 14 Holds assigned in the last three months. The average Shopify price target is $118.35, which implies a 25.9% upside from the current levels.