Cathie Wood’s ARK Invest ETFs (exchange-traded funds) made only three portfolio adjustments on Thursday, September 25, according to daily fund disclosures. The ace hedge fund manager continued trimming positions in streaming platform Roku (ROKU) and gaming giant Roblox (RBLX), while increasing exposure to biotech firm Arcturus Therapeutics (ARCT). The ARK Genomic Revolution ETF (ARKG) added 28,272 shares of Arcturus, valued at $542,661, signaling confidence in its growth potential.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Notably, these trades were smaller in dollar terms than Wood’s usual bets. Her portfolio shuffle reflects a cautious stance amid recent market swings, particularly in tech stocks, which have been driving volatility.

Wood Trims ROKU, RBLX Stakes

The largest trade of the day was the sale of 21,592 Roku shares worth $2.12 million by the ARK Innovation ETF (ARKK). This move is consistent with Wood’s ongoing strategy of booking profits on Roku after a near-32% price rally this year. Following these sales, ROKU now ranks as the third-largest holding across ARK’s combined portfolios, with a 4.66% weighting.

Similarly, Wood reduced exposure to the gaming platform Roblox, selling 10,667 shares for $1.42 million through the ARKK ETF. Wood also sold RBLX shares worth $2.71 million earlier this week, despite Roblox’s impressive 128% gain so far in 2025.

Wood could be scaling back on these stocks as the fund is reallocating shares toward sectors with perceived higher growth potential, such as biotech, AI, and the crypto sector.

Wall Street’s Take on ROKU, RBLX, and ARCT Stocks

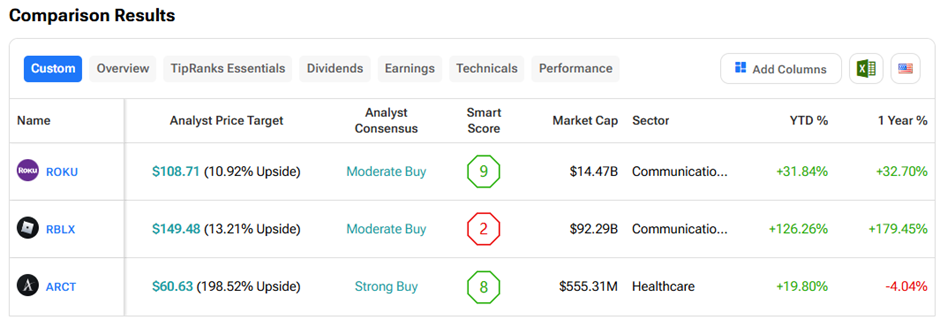

Wall Street’s view of Arcturus aligns with Wood’s recent purchases. Analysts have assigned ARCT stock a “Strong Buy” consensus rating, and the average Arcturus price target implies a 198% upside potential over the next 12 months.