Ark Invest’s Cathie Wood has been active lately as she recently sold over 320,000 shares of fintech giant Block (NYSE:SQ). The ARK Innovation ETF (ARKK) was the biggest seller at 232,529 shares, followed by ARK Next Generation Internet ETF (ARKW) and ARK Fintech Innovation ETF (ARKF) at 53,604 and 34,792 shares, respectively.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It’s worth mentioning that the stock has significantly underperformed the S&P 500 (SPX) so far in 2024, and the funds are probably looking to shift around some capital to other potential opportunities. Nevertheless, Cathie Wood is still a big believer in Block, and SQ stock remains a major holding across the three ETFs, making up a combined total of over $600 million.

Block May Continue Its Struggle

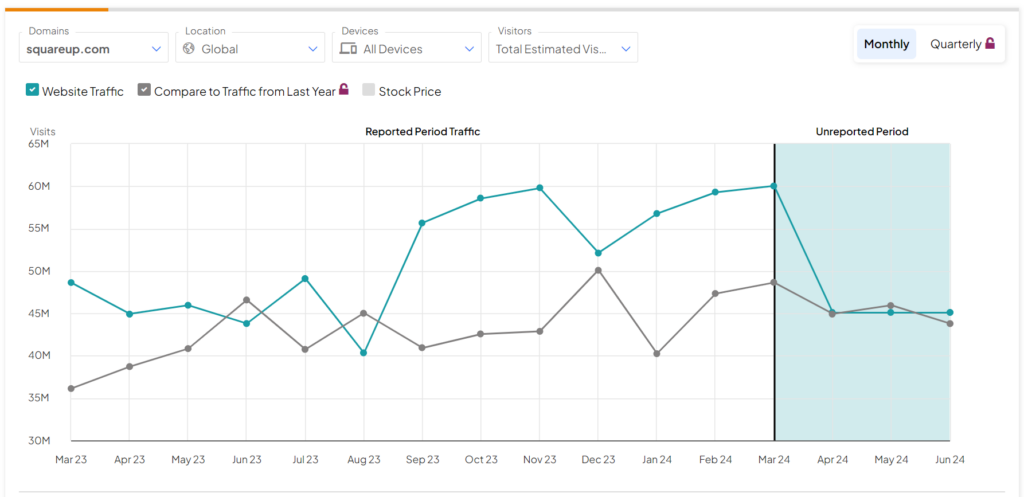

Looking forward, it’s possible that Block may continue its struggle in the near term. In fact, a quick look at Block’s website traffic highlights a significant drop in visitors. According to the image below, website traffic in April 2024 (greenish-blue line) fell to similar levels as the prior year (grey line). Interestingly, May 2024 is actually witnessing a year-over-year decline.

Is SQ a good stock to buy?

Turning to Wall Street, analysts have a Strong Buy consensus rating on SQ stock based on 28 Buys, five Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 28% rally in its share price over the past year, the average SQ price target of $90.67 per share implies 26.28% upside potential.