Cathie Wood’s ARK Invest ETFs (exchange-traded funds) made notable portfolio adjustments on Monday, September 29, according to daily fund disclosures. The ace hedge fund manager accumulated shares of biotech company Intellia Therapeutics (NTLA) and acquired shares of defense contractor L3Harris Technologies (LHX). Additionally, Wood made small purchases of Deere & Co. (DE) and Honeywell International (HON).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On the sell side, Wood continued trimming the fund’s stake in defense technology company Kratos Defense and Security Solutions (KTOS). The ARK Space Exploration & Innovation ETF (ARKX) sold 43,777 shares of Kratos yesterday, valued at $3.78 million. The previous day, the fund offloaded 70,874 shares of Kratos for $5.97 million.

This marks a strategic shift between two defense contractors, with Wood reducing Kratos shares while investing in L3Harris. Year-to-date, KTOS stock has surged nearly 234%, while LHX is up 43%.

Wood Accumulates L3Harris and Intellia Stocks

The ARKX ETF acquired 7,455 shares of L3Harris totaling $2.19 million, aligning with the fund’s thematic investment strategy. L3Harris has become a vital player in the U.S. military and defense sector. Yesterday, the company secured a $939.6 million contract from the U.S. Navy for development and production of Multifunctional Information Distribution System (MIDS) radio systems.

Furthermore, LHX secured $54.6 million in contracts from three different government agencies for equipment redesign and modernization.

At the same time, the ARK Innovation ETF (ARKK) and the ARK Genomic Revolution ETF (ARKG) together purchased about 112,198 shares of Intellia, totaling $1.83 million. Cathie Wood has been steadily accumulating biotech shares, betting on the future potential of gene-editing treatments. On Friday, Wood had purchased an additional $2.29 million worth of Intellia shares.

Wall Street’s Take on LHX, KTOS, and NTLA Stocks

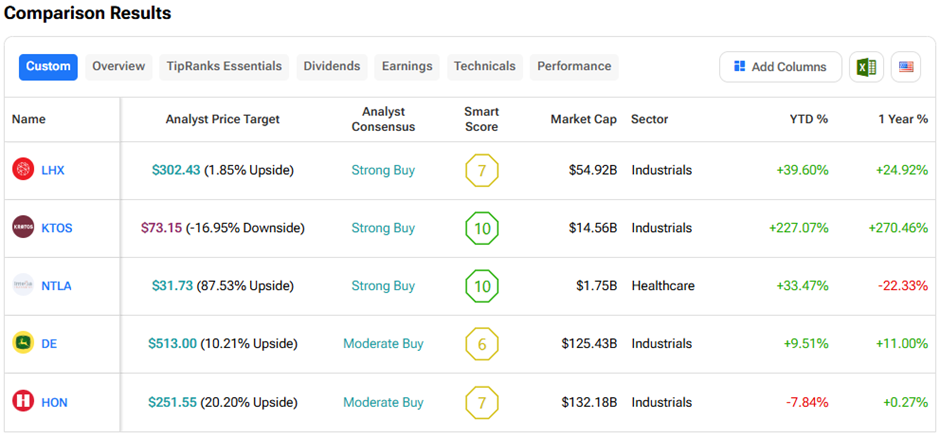

We used the TipRanks Stock Comparison Tool to determine which company is preferred by analysts.

Currently, Wall Street has assigned a “Strong Buy” consensus rating to L3Harris, Kratos Defense, and Intellia, with NTLA stock offering the highest upside potential over the next twelve months.