Cathay Pacific Airways Limited (HK:0293) cancelled flights from Hong Kong to several destinations to inspect engine issues on Airbus SE’s (DE:AIR) A350s. The company announced that it is inspecting all 48 Rolls-Royce (GB:RR)-powered Airbus A350 aircraft as a precaution after experiencing a part failure on an in-flight A350-1000 plane on Monday. According to the latest update, Cathay Pacific has found 15 Airbus A350 aircraft with components that require replacement.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Cathay Pacific shares were down by 0.50% at the time of writing. Meanwhile, RR stock fell over 6% on Monday, leading the FTSE 100 decliners. However, RR shares opened higher today and gained nearly 4% as of writing.

Cathay Pacific is Hong Kong’s premier airline that offers flights to more than 200 destinations across the globe.

Cathay Pacific Suspends Flights for A350 Inspections

On Monday, Cathay Pacific’s flight from Hong Kong to Zurich returned to Hong Kong after 75 minutes of its departure as a component in its engine broke down. Since that incident, the airline has grounded two dozen return flights, including those between Hong Kong and Sydney, Singapore, Bangkok, Tokyo, Osaka, and Taipei.

As part of its rectification efforts, Cathay identified the faulty engine component and said that it was the “first of its kind” failure on any A350 aircraft globally. The airline has started the repair work, which is expected to impact its operating schedules.

Rolls-Royce, in turn, has pledged its full support to the investigation into the incident, working alongside Airbus and the airline. The aircraft was powered by Rolls Royce’s Trent XWB-97 engines. RR, along with manufacturing these engines, also provides ongoing servicing while the aircraft is in operation. Recently, it secured several contracts for its Trent engines, including agreements with Cathay Pacific.

Is Cathay Pacific Stock a Buy?

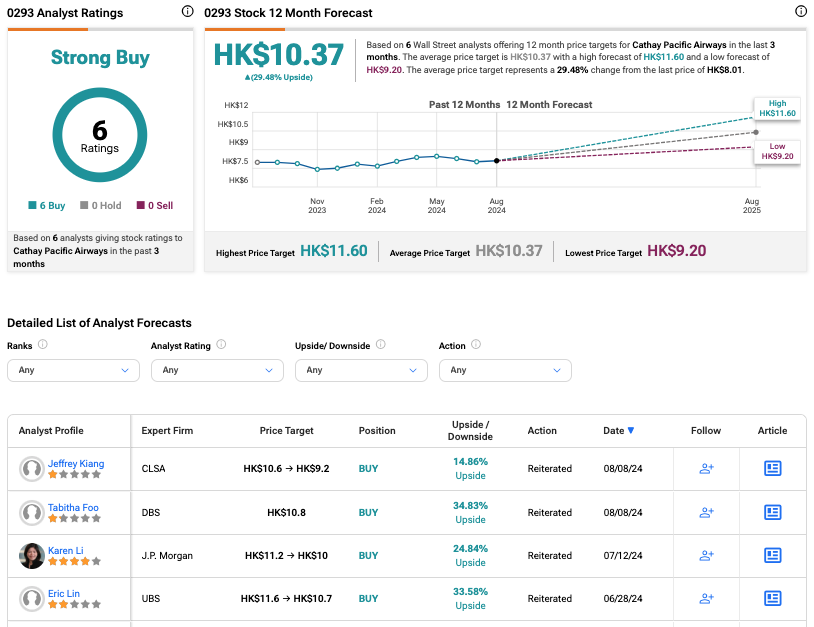

On TipRanks, 0293 stock carries a Strong Buy consensus rating, backed by all Buy recommendations from six analysts. The Cathay Pacific share price target of HK$10.37 implies an upside of 30% from the current level.