Cathay General Bancorp announced a new stock repurchase program of up to $75 million. Shares of the bank closed 1.7% higher on April 1.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Cathay General’s (CATY) announcement follows the completion of the company’s prior stock repurchase program of $50 million, which was announced on May 7, 2019, and completed on Dec. 9, 2020. Under the completed program, the company repurchased 1,541,912 shares at an average price of $32.43.

In January, Cathay General reported 4Q results. The company’s 4Q earnings rose 6% year-over-year to $0.89 per share and outpaced Street estimates of $0.76. Net interest income decreased 1% to $139.8 million. Additionally, net interest margin came in at 3.12%, down 22 basis points. (See Cathay General stock analysis on TipRanks)

On March 16, Piper Sandler analyst Matthew Clark lifted the stock’s price target to $47 (13.3% upside potential) from $37 and maintained a Hold rating after meeting with management.

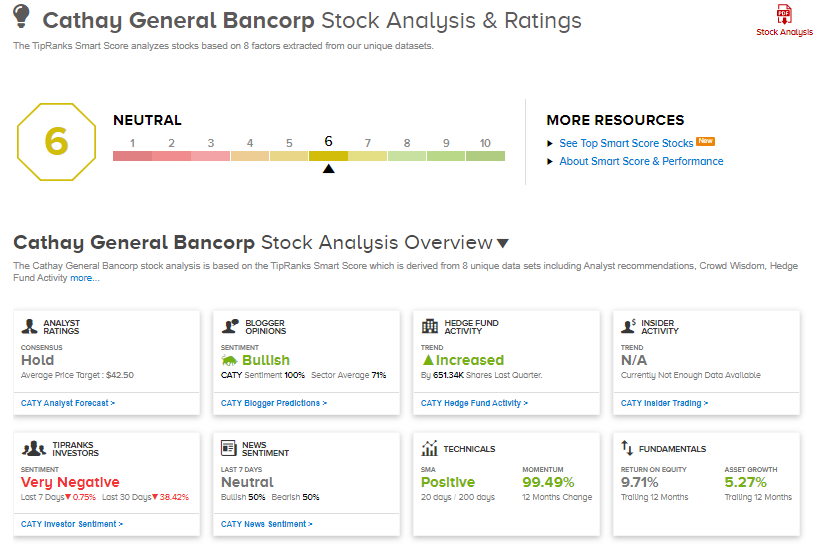

Overall, the stock has a Hold consensus rating based on 2 Holds. The average analyst price target of $42.50 implies 2.5% upside potential from current levels. Shares have increased 29.7% so far this year.

According to TipRanks’ Smart Score system, Cathay General gets a 6 out of 10, which indicates that the stock is likely to perform in line with market averages.

Related News:

TEGNA Bumps Up Quarterly Dividend By 36%

HarborOne Bumps Up Quarterly Dividend By 66.7%; Shares Gain 2%

Vipshop To Buy Back $500M In Stock; Shares Pop 9%