Caterpillar stock (CAT) roared back Tuesday after an unusually bullish move from 5-Star Baird analyst Mig Dobre, who upgraded the shares for the second time this month. The stock climbed 1.9% to $349.02 in morning trading. That easily beat the S&P 500’s 0.3% gain.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Baird Boosts Caterpillar Stock Forecast to $395

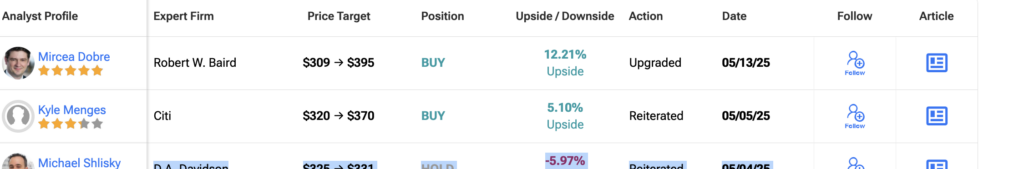

Dobre raised his rating to Buy from Hold and lifted his price target to $395 from $309. Just two weeks ago, he had upgraded the stock from Sell to Hold after the company’s first-quarter earnings. The back-to-back calls reflect what Dobre sees as a rare setup for upside. “A combination of lower-than-normal seasonal dealer inventory build, much better-than-expected orders/backlog, and stabilization in dealer retail sales all pointed to potential fundamental improvement into 2026,” Dobre wrote Tuesday.

Tariff Relief Adds fuel to Caterpillar Stock Rally

Caterpillar shares soared 5.2% on Monday after the U.S. and China agreed to dramatic 90-day tariff cuts. That news gave fresh life to a stock that had fallen about 4% year-to-date and 4% over the past 12 months. The company’s heavy-duty equipment business has been weighed down by softening global demand and rising trade tensions.

However, Dobre believes the worst is behind the company. He projects a rebound in 2026 with earnings per share exceeding $21 per share. “Investors like to buy CAT stock when earnings are at their cyclical lows, before things improve,” Dobre explained.

Is Caterpillar a Buy, Hold, or Sell?

According to TipRanks, Caterpillar stock holds a Moderate Buy consensus. Out of 13 analysts who issued ratings in the past three months, seven rate Caterpillar a Buy, five say Hold, and just one recommends Sell. The average 12-month CAT price forecast is $355.25, offering only a modest 0.39% upside from the current $353.88. The highest analyst target stands at $425, while the lowest bearish call sits at $243.