Leading diagnostic tools maker Danaher (NYSE:DHR) is no longer interested in acquiring Catalent (NYSE:CTLT), Bloomberg reported. The move comes after Catalent provided a business update on Friday, April 14, which dragged its stock price significantly lower.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The life sciences company said it expects productivity issues and higher-than-expected costs at three of its facilities to significantly impact its Q3 financials and the full-year outlook. Following the announcement, CTLT stock closed about 27% lower on April 14. Catalent will announce its third-quarter earnings on Tuesday, May 9.

Earlier in February, a Bloomberg report highlighted that Danaher was interested in buying CTLT at a significant premium. However, given the considerable decline in CTLT stock and near-term operational challenges, Danaher’s move appears correct.

Concurrently, the company, in an SEC filing on Monday, announced that its co-founder and Chairman, Steven Rales bought 125,437 shares of DHR. The company’s top insiders buying shares signify their confidence in the company’s future prospects, which is a positive development for DHR’s shareholders.

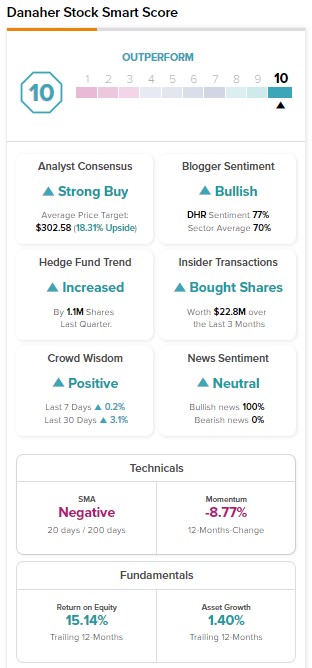

It’s worth highlighting here that our Insider Trading Activity tool shows that DHR’s top insiders bought shares worth $22.8M in the last quarter.

While the company’s top insiders are accumulating its stock, let’s check what analysts recommend about DHR.

Is DHR Stock a Buy?

DHR stock has received 11 Buy and one Hold recommendations from Wall Street analysts, implying a Strong Buy consensus rating. At the same time, these analysts have a price target of $302.58 on DHR, indicating 18.31% upside potential.

Besides for analysts, DHR stock has positive signals from insiders and hedge funds. It sports a maximum Smart Score of “Perfect 10” on TipRanks.