When a company like online used car vendor Carvana (NASDAQ:CVNA) loses its license to operate in Michigan, one might think that the writing is on the wall. Not according to investors, however, who at one point in Wednesday’s trading sent the stock up over 24%. It gave back a lot of those gains, but many are beginning to wonder why Carvana is up at all.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Some believe that Carvana is just the latest in a growing line of “meme stocks.” Like GameStop (NYSE:GME) and others before it, “meme stocks” are stocks that shot up on a wave of mainly online-generated enthusiasm. Yet if that were the case, then those who believe such would have to explain how Goldman Sachs (NYSE:GS) fell for such a simple ploy, as it recently increased its own position in Carvana. Goldman Sachs increased its position from 5.3% ownership to 8.3% ownership with its latest 13G filing.

Regardless of the underlying motives, it’s clear that Carvana stock is extremely volatile right now. In fact, earlier today, trading in Carvana was halted for a while. Some even believe that Carvana stock is currently in the middle of a short-squeeze trap. Meanwhile, others believe that Carvana may run out of money soon. With most conventional sources of funding unavailable, that poses risk in and of itself.

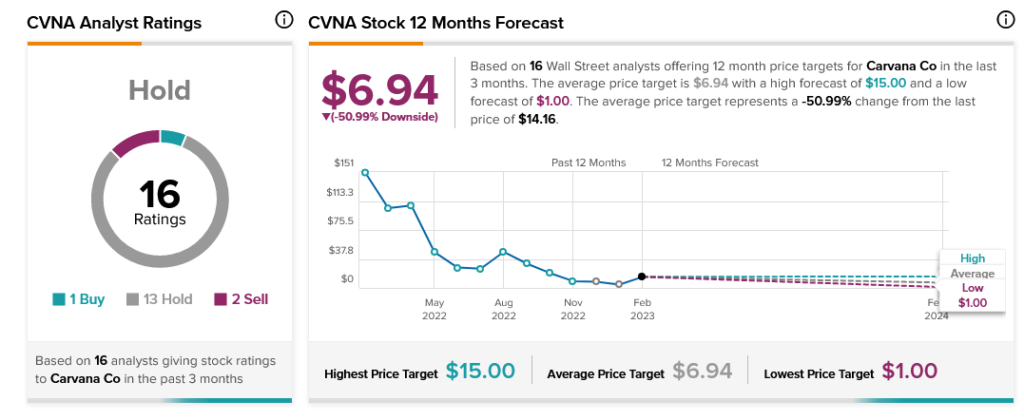

Many analysts are sitting the entire discussion out altogether, as consensus calls Carvana stock a Hold. With an average price target of $6.94, it also features a downside risk of 50.99%.