Cruise ship operator Carnival (NYSE:CCL) will release its first quarter Fiscal 2024 results on March 27, before the market opens. The company’s Q1 will likely benefit from strong travel demand, higher occupancy levels, and an increase in ticket prices. However, the rerouting and cancellation of certain itineraries around the Red Sea could remain a drag and impact its bottom line.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Notably, CCL stock has gained about 95% in the past year and has outperformed the S&P 500 Index’s (SPX) rally of 32%.

CCL – Q1 Expectations

Wall Street expects Carnival to report sales of $5.33 billion in Q1, up 21.1% year over year. Strong booking trends and favorable pricing are expected to bolster Carnival’s revenues.

Turning to bottom-line expectations, the company is expected to post a loss of $0.18 per share, compared with a loss of $0.55 in the year-ago quarter.

Analysts Weigh In

William Blair analyst Sharon Zackfia reiterated a Buy rating on Carnival stock ahead of the Q1 print. The analyst expects higher bookings and increased onboard customer spending to drive its financials in the first quarter.

Echoing similar sentiments, Paul Golding from Macquarie maintained a bullish stance on CCL stock on March 18. The analyst expects high booking volumes and strong pricing to drive the company’s revenue and EBITDA.

Is CCL a Good Stock to Buy?

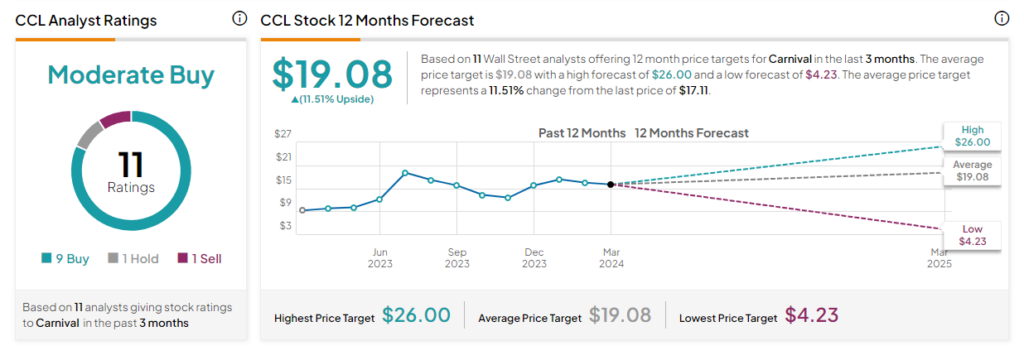

Overall, Wall Street is cautiously optimistic about CCL. The stock has a Moderate Buy consensus rating based on nine Buys, one Hold, and one Sell rating assigned in the past three months. The analysts’ average price target on CCL stock of $19.08 implies 11.51% upside potential.

Insights from Options Trading Activity

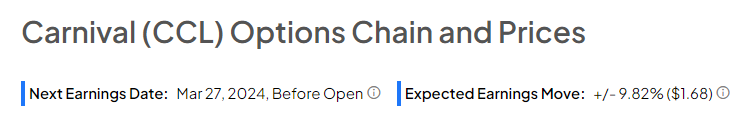

TipRanks presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a +/- 9.82% move on CCL’s earnings, compared with the previous quarter’s earnings-related move of 6.2%.

The anticipated earnings move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Concluding Thoughts

Carnival’s effort to add new ships reflects its confidence in future performance and positions it well to meet rising demand. Interestingly, the company ordered a new excel-class cruise ship, boasting a passenger capacity of 6,400, last month. Thus, growing capacity, higher ticket prices, and strong demand keep CCL well poised for growth.