The ongoing Israel-Hamas war, which in several ways may be expanding if it hasn’t really already done so, is fundamentally shifting the way a lot of businesses operate in that area. Carnival Cruise Lines (NYSE:CCL) has cruises going out to the Red Sea, reports note, and they’ve modified the itineraries accordingly. The changes will impact 12 different ships over seven different brands, all of which were originally scheduled to go through the Red Sea between now and May 2024.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The biggest risk to cruise ships in that area would seem to come from the Houthi rebels in Iran, who have already been seen firing on cargo ships in that area. So, Carnival is doing the responsible thing and bypassing the area altogether.

Fighting for Customers Through Disasters

Things haven’t exactly been going well for Carnival these days, but it’s trying to pull things out nonetheless. A cruise to the Bahamas, for example, proved terrible for many passengers who came down with an unexpected illness aboard the ship. Food poisoning and norovirus were both mentioned in connection with the incidents, which isn’t a disaster for Carnival but might have some negative impact. However, Carnival also announced that a longtime favorite food item will be returning, as cruises will bring back Beef Wellington on dinner services. Carnival may have some troubles from time to time, but its responsiveness to customers certainly can’t hurt.

What Is the prediction for Carnival Stock?

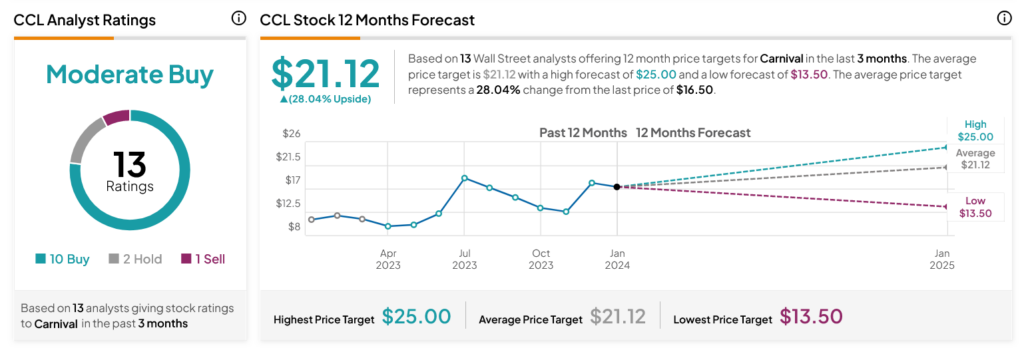

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CCL stock based on 10 Buys, two Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 52.5% rally in its share price over the past year, the average CCL price target of $21.12 per share implies 28.04% upside potential.