While not many folks were thinking of a cruise with the last holiday week, it might well be that some spent their Thanksgiving on the high seas. And it’s been quite a bit of good news for Carnival Cruise Lines (NYSE:CCL) of late, as it’s up fractionally in Monday afternoon’s trading with some new analyst outlook and some interesting new developments besides that.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The latest word came from Melius Research analyst Conor Cunningham, who hiked his rating on Carnival from Hold to Buy. He left the price target alone, however, sitting at $19. But even that was still up a long way from the Friday close of $14.41. Cunningham pointed out that Carnival has already been a major player in the market this year, among the top 10 in the S&P 500.

But Cunningham doesn’t look for the ride to stop here; rather, he looks for the demand for cruise vacations to continue into next year. He actually expects not only record demand but also record prices, which should be great news for Carnival’s bottom line.

Carnival Reinforces Its Position

Record demand at record prices sounds great, but then you’ve got to process all that demand. The good news there is that Carnival is on track to be able to handle the job. It has recently withdrawn its plans for “fire-and-rehire,” which was met with no shortage of controversy when first announced.

Fire-and-rehire, for those not familiar, is a labor negotiating tactic where a business does pretty much that — fires a whole bunch of people only to rehire many of them later, often under different job descriptions and circumstances.

Meanwhile, the Carnival Panorama, one of Carnival’s biggest ships, is facing serious problems with “air draft” that need repairing. The vessel’s air draft is, specifically, too big to get it into the only shipyard it can reach soon for repairs, and Carnival needs all hands on deck for holiday cruises.

What is the Price Target for CCL?

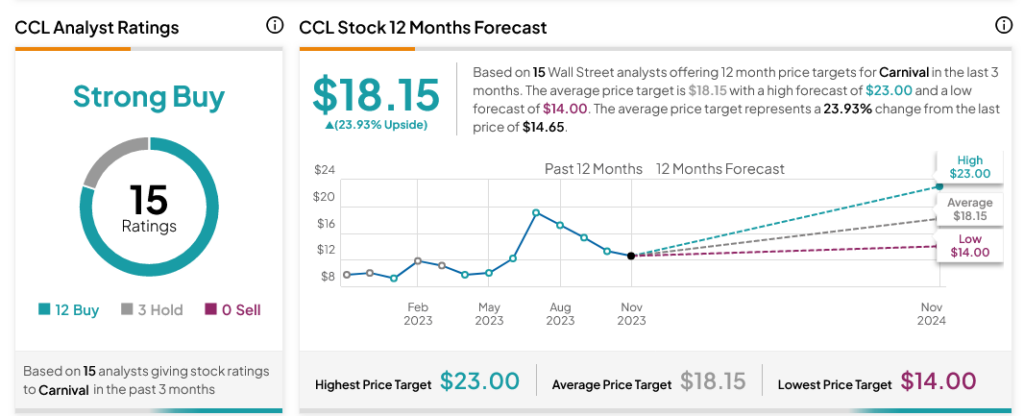

Turning to Wall Street, analysts have a Strong Buy consensus rating on CCL stock based on 12 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 56.17% rally in its share price over the past year, the average CCL price target of $18.15 per share implies 23.93% upside potential.